Umair Square-Creator-31897cc37df3b2d2890c

Ouvert au trading

Détenteur pour BNB

Trade occasionnellement

2.4 an(s)

3 Suivis

47 Abonnés

14 J’aime

0 Partagé(s)

Publications

Portefeuille

Bitcoin Update (BTC)**

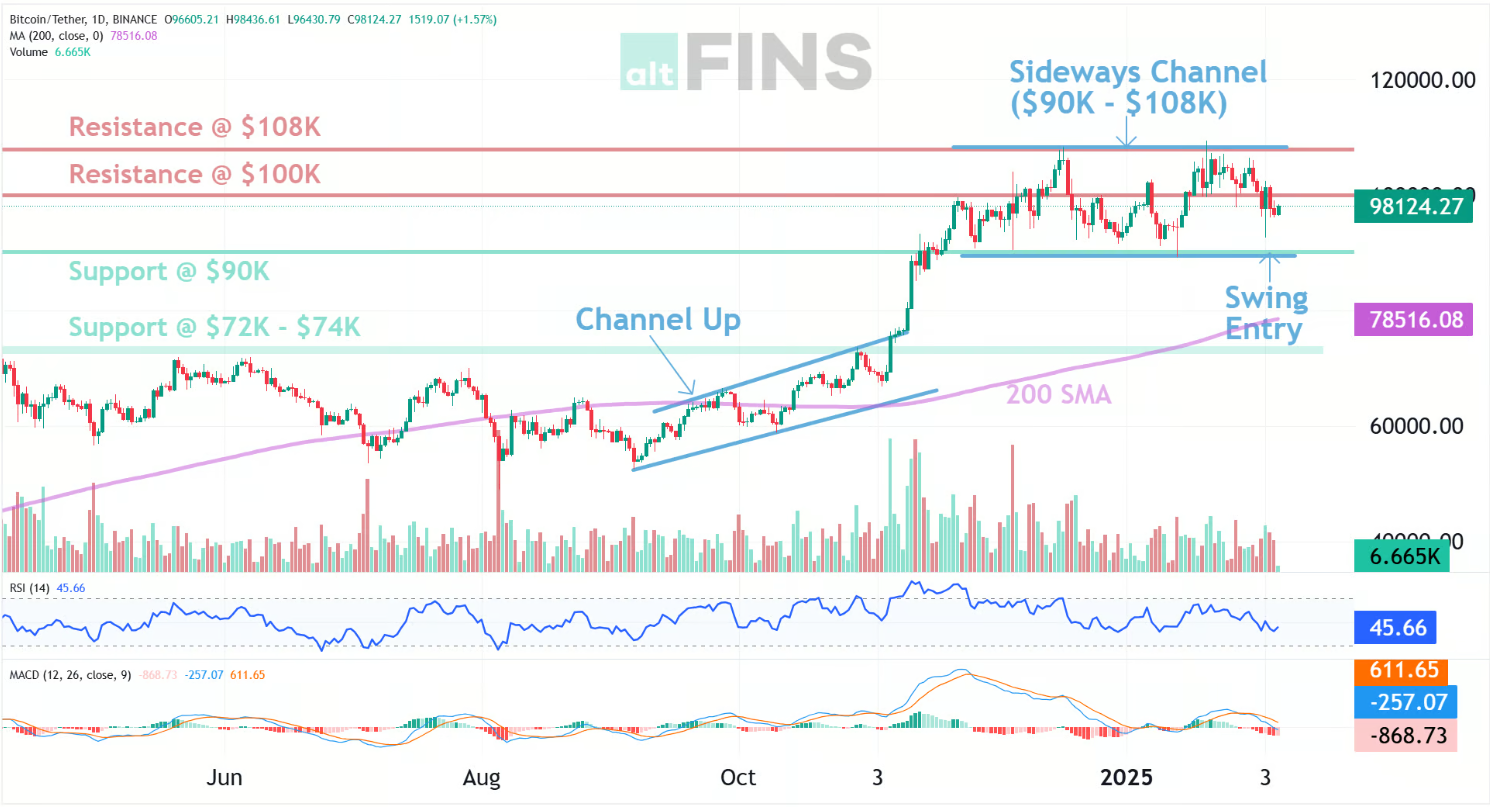

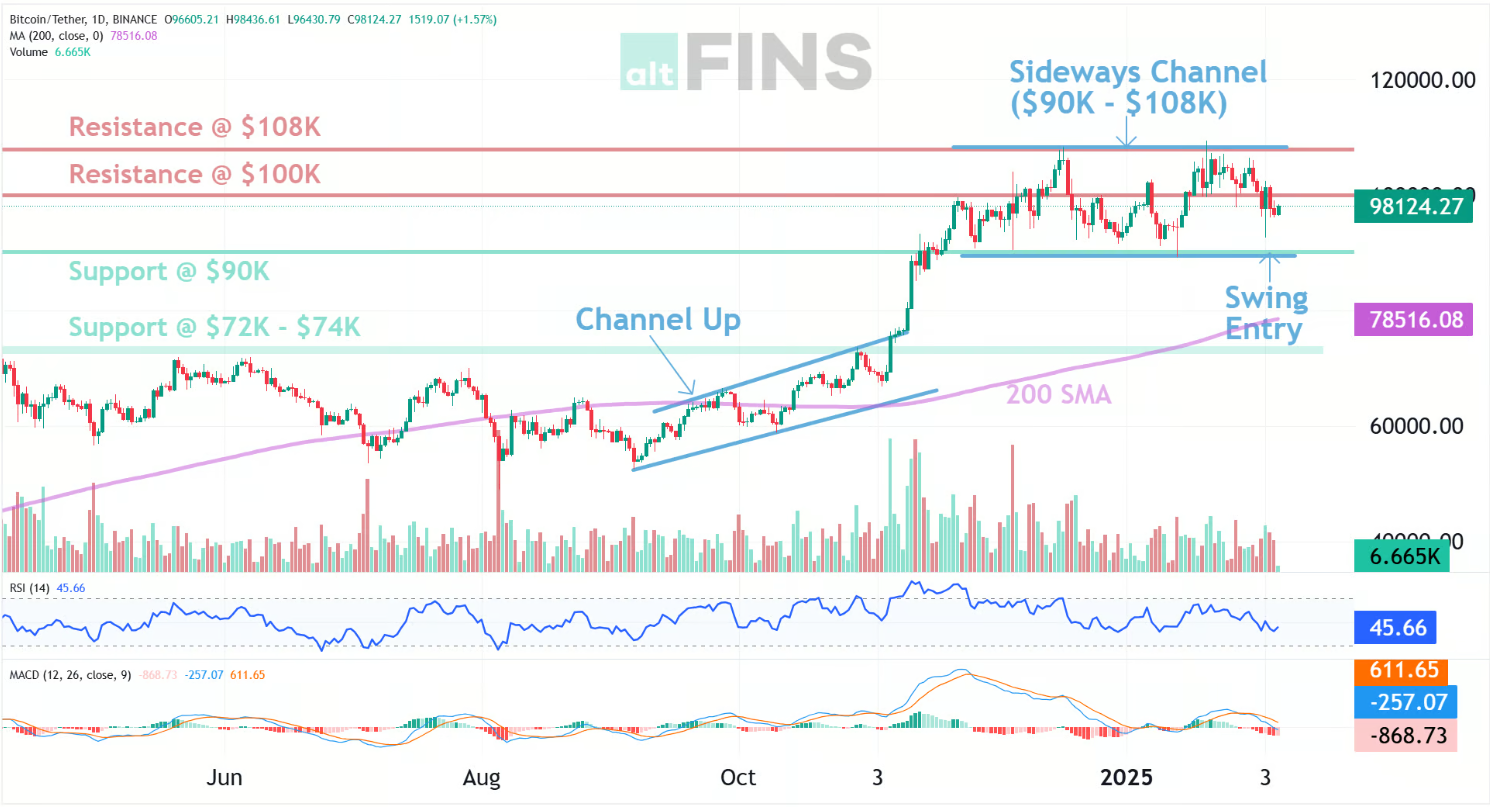

$BTC is **moving sideways near key resistance**, showing consolidation.

📉 Short-term pressure remains, but **support is holding**.

📈 A breakout above resistance could trigger the **next bullish move**.

⚠️ If support breaks, expect **more volatility**.

🖼️ *Use:*

• BTC price chart

• Support & resistance chart

• Market sentiment image

**Summary:** Market is waiting for a **clear breakout or breakdown**.

$BTC

#USGDPUpdate #USCryptoStakingTaxReview #USJobsData #BTC #BinanceAlphaAlert

$BTC is **moving sideways near key resistance**, showing consolidation.

📉 Short-term pressure remains, but **support is holding**.

📈 A breakout above resistance could trigger the **next bullish move**.

⚠️ If support breaks, expect **more volatility**.

🖼️ *Use:*

• BTC price chart

• Support & resistance chart

• Market sentiment image

**Summary:** Market is waiting for a **clear breakout or breakdown**.

$BTC

#USGDPUpdate #USCryptoStakingTaxReview #USJobsData #BTC #BinanceAlphaAlert

Bitcoin Latest Analysis

🧠 Current Price Action

$BTC has been consolidating around the high $80K–$90K range, with price action showing limited momentum as buyers and sellers remain balanced. Market sentiment stays cautious as BTC trades beneath strong resistance levels.

Analytics Insight

+1

📈 Bullish Possibilities

• Analysts highlight possible recovery toward $90K–$95K if BTC breaks above near-term resistance.

MEXC

• Institutional interest and macro factors like rate cuts are watched as potential catalysts for a rebound.

AInvest

📉 Bearish / Risk Signals

• Price action still faces pressure and range-bound trading, with potential for deeper corrections if key support fails.

CryptoPotato

• Some analysts even warn of downside targets if broader market sentiment worsens.

Coinlive

$BTC

#USGDPUpdate #USCryptoStakingTaxReview #WriteToEarnUpgrade #USJobsData #BTC

🧠 Current Price Action

$BTC has been consolidating around the high $80K–$90K range, with price action showing limited momentum as buyers and sellers remain balanced. Market sentiment stays cautious as BTC trades beneath strong resistance levels.

Analytics Insight

+1

📈 Bullish Possibilities

• Analysts highlight possible recovery toward $90K–$95K if BTC breaks above near-term resistance.

MEXC

• Institutional interest and macro factors like rate cuts are watched as potential catalysts for a rebound.

AInvest

📉 Bearish / Risk Signals

• Price action still faces pressure and range-bound trading, with potential for deeper corrections if key support fails.

CryptoPotato

• Some analysts even warn of downside targets if broader market sentiment worsens.

Coinlive

$BTC

#USGDPUpdate #USCryptoStakingTaxReview #WriteToEarnUpgrade #USJobsData #BTC

Bitcoin Latest Analysis

Market Snapshot:

$BTC continues to hover around the mid-$80,000 to low-$90,000 range, struggling to break solidly above key resistance levels this week. BTC’s price action shows consolidation with mixed momentum, as buyers and sellers battle for direction.

Bitcoin News

+1

Bullish Signals:

📈 Some analysts maintain year-end targets near $98K–$104K if Bitcoin reclaims resistance and gains upside momentum.

MEXC

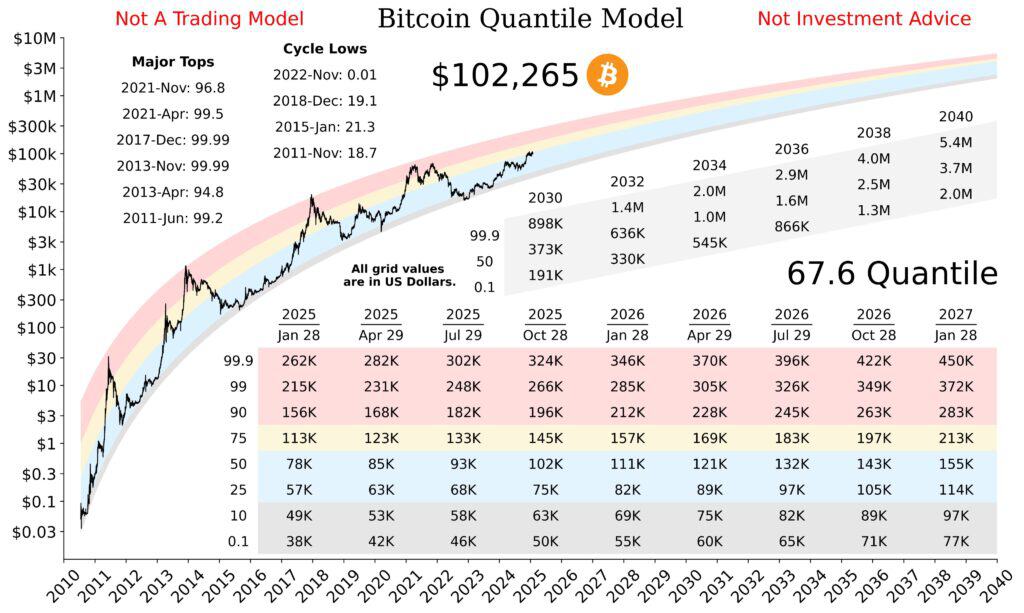

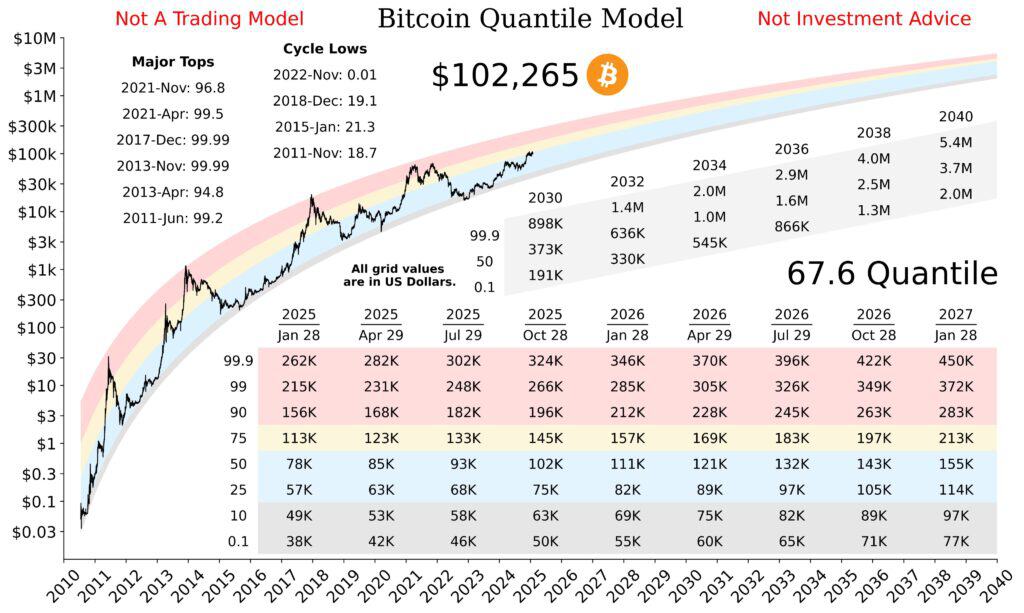

📊 Long-term models still project higher potential in 2026, with robust institutional interest and ETF flows cited as positive drivers.

CoinDesk

Bearish / Caution Flags:

⚠️ Recent price drops below $88,000 support and tight trading ranges signal weaker short-term strength.

CryptoRank

⚠️ BTC remains stuck under important cap levels — failure to break higher could keep it range-bound or push it lower.

$BTC

#USNonFarmPayrollReport #BTCVSGOLD #TrumpTariffs #BTC #USJobsData

Market Snapshot:

$BTC continues to hover around the mid-$80,000 to low-$90,000 range, struggling to break solidly above key resistance levels this week. BTC’s price action shows consolidation with mixed momentum, as buyers and sellers battle for direction.

Bitcoin News

+1

Bullish Signals:

📈 Some analysts maintain year-end targets near $98K–$104K if Bitcoin reclaims resistance and gains upside momentum.

MEXC

📊 Long-term models still project higher potential in 2026, with robust institutional interest and ETF flows cited as positive drivers.

CoinDesk

Bearish / Caution Flags:

⚠️ Recent price drops below $88,000 support and tight trading ranges signal weaker short-term strength.

CryptoRank

⚠️ BTC remains stuck under important cap levels — failure to break higher could keep it range-bound or push it lower.

$BTC

#USNonFarmPayrollReport #BTCVSGOLD #TrumpTariffs #BTC #USJobsData

Bitcoin Latest Analysis (Dec 20, 2025)

🔹 Price & Market Trend

$BTC has been range-bound near mid-$80K to $90K levels, showing choppy action as bulls and bears fight for direction. Recent rebounds around $88K were met with mixed market sentiment, and price has struggled to sustain a larger breakout. CoinDesk+1

📈 Bullish Signals

• Some analysts forecast strong long-term upside, with major institutions like Citi projecting BTC could reach around $143,000 in the next year in a bullish scenario. Bitcoin Magazine

• Large wallets (“whales”) have been accumulating, indicating some confidence at lower levels. Pintu

📉 Caution / Bearish Risk

• Short-term momentum remains weak as Bitcoin faces resistance above $90K–$95K and continued volatility. Forex

• Traders are watching key support levels — a failure there could extend the current correction.

$BTC

#USNonFarmPayrollReport #USJobsData #BTCVSGOLD #BTC #BinanceBlockchainWeek

🔹 Price & Market Trend

$BTC has been range-bound near mid-$80K to $90K levels, showing choppy action as bulls and bears fight for direction. Recent rebounds around $88K were met with mixed market sentiment, and price has struggled to sustain a larger breakout. CoinDesk+1

📈 Bullish Signals

• Some analysts forecast strong long-term upside, with major institutions like Citi projecting BTC could reach around $143,000 in the next year in a bullish scenario. Bitcoin Magazine

• Large wallets (“whales”) have been accumulating, indicating some confidence at lower levels. Pintu

📉 Caution / Bearish Risk

• Short-term momentum remains weak as Bitcoin faces resistance above $90K–$95K and continued volatility. Forex

• Traders are watching key support levels — a failure there could extend the current correction.

$BTC

#USNonFarmPayrollReport #USJobsData #BTCVSGOLD #BTC #BinanceBlockchainWeek

Bitcoin Price & Market Snapshot

$BTC is still trading in a choppy range near key support and resistance levels, with price struggling to break clear direction as the year closes. Recent data shows BTC testing critical supports and immediate resistance — meaning traders are watching closely for either a breakout or further pullback.

Blockchain News

+1

📈 Bullish Signals

🔹 Short-term technical analysis suggests BTC could recover toward ~$92,000–$94,000 if support holds and momentum improves.

Blockchain News

🔹 On-chain and accumulation metrics show long-term holders staying active, pointing to sustained interest even amid volatility.

interactivecrypto.com

📉 Bearish / Caution Flags

🔸 Bitcoin has been range-bound with failed breakouts above near-term resistance, keeping upside capped for now.

$BTC

#USNonFarmPayrollReport #BinanceBlockchainWeek #TrumpTariffs #BTC #CryptoRally

$BTC is still trading in a choppy range near key support and resistance levels, with price struggling to break clear direction as the year closes. Recent data shows BTC testing critical supports and immediate resistance — meaning traders are watching closely for either a breakout or further pullback.

Blockchain News

+1

📈 Bullish Signals

🔹 Short-term technical analysis suggests BTC could recover toward ~$92,000–$94,000 if support holds and momentum improves.

Blockchain News

🔹 On-chain and accumulation metrics show long-term holders staying active, pointing to sustained interest even amid volatility.

interactivecrypto.com

📉 Bearish / Caution Flags

🔸 Bitcoin has been range-bound with failed breakouts above near-term resistance, keeping upside capped for now.

$BTC

#USNonFarmPayrollReport #BinanceBlockchainWeek #TrumpTariffs #BTC #CryptoRally

S$BTC action de prix à court terme

Bitcoin a récemment été négocié plus faiblement, glissant près des 80 000 $ amid une pression de vente continue et des sorties d'ETF. CoinDesk+1

Plusieurs médias rapportent une tendance à la baisse depuis les récents sommets, avec un prix échouant à reprendre des zones de résistance clés et visant potentiellement un support inférieur si l'élan baissier persiste. CryptoPotato+1

🧠 Signaux techniques et de sentiment

Le marché est largement considéré comme survendu sur des périodes plus courtes, mais les analystes ne sont pas encore convaincus qu'un solide creux est en place. CoinDesk

Les données en chaîne suggèrent qu'une grande partie des ventes récentes provient de détenteurs à court terme, tandis que les détenteurs à long terme restent largement stables. Reddit

📊 Niveaux clés à surveiller

Support : zone de ~$80,000–$85,000 (critique pour les taureaux). Blockchain News

Résistance : Une rupture au-dessus de ~$94,000–$95,000 est nécessaire pour changer vers une perspective plus haussière. Blockchain News

📈 Scénarios haussiers vs baissiers

Cas haussier :

• La continuation de la plage et une rupture au-dessus de ~$95,000–$105,000 pourrait rallumer l'élan haussier d'ici la fin de l'année. Blockchain News

• Des rallies à court terme ciblant environ ~$91,000–$92,000 restent possibles si la structure du marché se stabilise. Blockchain News

Risque baissier :

• Une rupture décisive en dessous du support de $85,000 pourrait entraîner des retracements plus profonds ou une consolidation prolongée. Blockchain News

🧩 Contexte du marché

La performance annuelle de Bitcoin s'est adoucie après de forts sommets en 2025, et la saisonnalité de décembre a historiquement tendance à être plus faible lorsque les mois précédents se terminent à la baisse. MEXC

Un sentiment macro plus large et de risque off (par exemple, crypto vs. actifs traditionnels comme l'or) continue d'influencer le comportement des prix de BTC. Barron's

Résumé : L'action à court terme est chaotique et limitée par une plage avec un léger biais baissier à moins que la résistance clé ne soit reprise. Les taureaux ont besoin de sommets plus élevés et de volume pour reprendre le contrôle, tandis que les ours surveillent une rupture du support pour une faiblesse supplémentaire. Pensez toujours à la gestion des risques - les marchés de la crypto restent volatils.

$BTC

#USNonFarmPayrollReport #CPIWatch #TrumpTariffs #USJobsData #BTC

Bitcoin a récemment été négocié plus faiblement, glissant près des 80 000 $ amid une pression de vente continue et des sorties d'ETF. CoinDesk+1

Plusieurs médias rapportent une tendance à la baisse depuis les récents sommets, avec un prix échouant à reprendre des zones de résistance clés et visant potentiellement un support inférieur si l'élan baissier persiste. CryptoPotato+1

🧠 Signaux techniques et de sentiment

Le marché est largement considéré comme survendu sur des périodes plus courtes, mais les analystes ne sont pas encore convaincus qu'un solide creux est en place. CoinDesk

Les données en chaîne suggèrent qu'une grande partie des ventes récentes provient de détenteurs à court terme, tandis que les détenteurs à long terme restent largement stables. Reddit

📊 Niveaux clés à surveiller

Support : zone de ~$80,000–$85,000 (critique pour les taureaux). Blockchain News

Résistance : Une rupture au-dessus de ~$94,000–$95,000 est nécessaire pour changer vers une perspective plus haussière. Blockchain News

📈 Scénarios haussiers vs baissiers

Cas haussier :

• La continuation de la plage et une rupture au-dessus de ~$95,000–$105,000 pourrait rallumer l'élan haussier d'ici la fin de l'année. Blockchain News

• Des rallies à court terme ciblant environ ~$91,000–$92,000 restent possibles si la structure du marché se stabilise. Blockchain News

Risque baissier :

• Une rupture décisive en dessous du support de $85,000 pourrait entraîner des retracements plus profonds ou une consolidation prolongée. Blockchain News

🧩 Contexte du marché

La performance annuelle de Bitcoin s'est adoucie après de forts sommets en 2025, et la saisonnalité de décembre a historiquement tendance à être plus faible lorsque les mois précédents se terminent à la baisse. MEXC

Un sentiment macro plus large et de risque off (par exemple, crypto vs. actifs traditionnels comme l'or) continue d'influencer le comportement des prix de BTC. Barron's

Résumé : L'action à court terme est chaotique et limitée par une plage avec un léger biais baissier à moins que la résistance clé ne soit reprise. Les taureaux ont besoin de sommets plus élevés et de volume pour reprendre le contrôle, tandis que les ours surveillent une rupture du support pour une faiblesse supplémentaire. Pensez toujours à la gestion des risques - les marchés de la crypto restent volatils.

$BTC

#USNonFarmPayrollReport #CPIWatch #TrumpTariffs #USJobsData #BTC

Bitcoin (BTC) – Latest Market Update

$BTC is currently trading near a key support zone, showing short-term weakness after facing rejection from higher levels. Market momentum remains volatile, with sellers active below resistance.

🔻 Support: $85K – strong buying area

🔺 Resistance: $90K – breakout needed for bullish continuation

📉 If BTC holds above support, a relief bounce is possible.

📈 A clean break above resistance could trigger fresh upside momentum.

$BTC

#USNonFarmPayrollReport #BinanceBlockchainWeek #BTCVSGOLD #BTC #CryptoRally

$BTC is currently trading near a key support zone, showing short-term weakness after facing rejection from higher levels. Market momentum remains volatile, with sellers active below resistance.

🔻 Support: $85K – strong buying area

🔺 Resistance: $90K – breakout needed for bullish continuation

📉 If BTC holds above support, a relief bounce is possible.

📈 A clean break above resistance could trigger fresh upside momentum.

$BTC

#USNonFarmPayrollReport #BinanceBlockchainWeek #BTCVSGOLD #BTC #CryptoRally

$BTC bitcoin latest analysis gleusercontent.com/docsz/AD_4nXcofuYwN60wYgtXqf4KpVONbapgVuS35L7whjVGexJLtAPVxS9AFyZ2n4_AFndhNTorYzyOtJVmocCpoObxdoZWq5Y7N5iCcUJ7jc-oI-syy01PDCRRMzoqMA0CfM8beD3IFVMW3A?key=SSe2fUjnmDVhvTTmd_L5uLeB)

### **📊 BTC Latest Market Snapshot (Dec 2025)**

**Bitcoin price** is showing **choppy movement** as bulls and bears battle near key levels. Traders are watching for a breakout above resistance or a break below support to confirm the next trend. ([Forex][1])

### **🔑 Technical View**

✔ BTC remains **range-bound** with sideways price action — indecision dominating the market. ([Forex][2])

✔ Analysts see **mixed signals**: resistance holds near current levels and short-term momentum is soft. ([Forex][1])

### **💡 Market Drivers**

• **ETF flows & macro sentiment** are key short-term drivers — inflows can fuel upside. ([CoinDCX][3])

• **Seasonal patterns** suggest December can be weak historically, potentially extending consolidation or pullbacks. ([MEXC][4])

### **📈 Outlook**

• **Bullish case:** Break above resistance could revive rally toward higher targets. ([MEXC][5])

• **Bearish risk:** Failure to hold support may deepen correction. ([MEXC][4])

$BTC

#USJobsData #CPIWatch #WriteToEarnUpgrade #BTCVSGOLD #BTC

### **📊 BTC Latest Market Snapshot (Dec 2025)**

**Bitcoin price** is showing **choppy movement** as bulls and bears battle near key levels. Traders are watching for a breakout above resistance or a break below support to confirm the next trend. ([Forex][1])

### **🔑 Technical View**

✔ BTC remains **range-bound** with sideways price action — indecision dominating the market. ([Forex][2])

✔ Analysts see **mixed signals**: resistance holds near current levels and short-term momentum is soft. ([Forex][1])

### **💡 Market Drivers**

• **ETF flows & macro sentiment** are key short-term drivers — inflows can fuel upside. ([CoinDCX][3])

• **Seasonal patterns** suggest December can be weak historically, potentially extending consolidation or pullbacks. ([MEXC][4])

### **📈 Outlook**

• **Bullish case:** Break above resistance could revive rally toward higher targets. ([MEXC][5])

• **Bearish risk:** Failure to hold support may deepen correction. ([MEXC][4])

$BTC

#USJobsData #CPIWatch #WriteToEarnUpgrade #BTCVSGOLD #BTC

$BTC **Bitcoin (BTC) – Market Update (Long Version) 📊**

Bitcoin is currently trading around **$90K**, showing **high volatility and consolidation** after failing to hold above previous support levels. The price is moving within a **key range between $85K and $93K**, indicating market indecision.

From a **technical perspective**, BTC faces **strong resistance near $94K–$97K**. A clean breakout above this zone could restart bullish momentum. On the downside, **$85K is a critical support** — losing it may trigger a deeper correction.

**Macro factors** are heavily influencing price action. Expectations around **Federal Reserve rate cuts, ETF inflows/outflows, and liquidity conditions** are driving short-term sentiment. While ETF demand has slowed, **elevated stablecoin reserves on exchanges** suggest there is potential buying power waiting for confirmation.

**Institutional outlook** has turned more cautious. Some banks have revised **2025 targets closer to $100K**, citing slower inflows and market uncertainty. However, this does not invalidate the longer-term bullish structure.

### 🔮 Outlook

* **Short term:** Range-bound, volatile, news-driven

* **Bullish case:** ETF growth, regulatory clarity, renewed liquidity

* **Bearish risk:** Weak demand + macro pressure

$BTC

#BTCVSGOLD #CPIWatch #USJobsData #BTC #BinanceBlockchainWeek

Bitcoin is currently trading around **$90K**, showing **high volatility and consolidation** after failing to hold above previous support levels. The price is moving within a **key range between $85K and $93K**, indicating market indecision.

From a **technical perspective**, BTC faces **strong resistance near $94K–$97K**. A clean breakout above this zone could restart bullish momentum. On the downside, **$85K is a critical support** — losing it may trigger a deeper correction.

**Macro factors** are heavily influencing price action. Expectations around **Federal Reserve rate cuts, ETF inflows/outflows, and liquidity conditions** are driving short-term sentiment. While ETF demand has slowed, **elevated stablecoin reserves on exchanges** suggest there is potential buying power waiting for confirmation.

**Institutional outlook** has turned more cautious. Some banks have revised **2025 targets closer to $100K**, citing slower inflows and market uncertainty. However, this does not invalidate the longer-term bullish structure.

### 🔮 Outlook

* **Short term:** Range-bound, volatile, news-driven

* **Bullish case:** ETF growth, regulatory clarity, renewed liquidity

* **Bearish risk:** Weak demand + macro pressure

$BTC

#BTCVSGOLD #CPIWatch #USJobsData #BTC #BinanceBlockchainWeek

$GIGGLE (GGL) – Dernière analyse courte**

$GIGGLE montre **une forte dynamique haussière**, avec des sommets de plus en plus élevés se formant de manière cohérente. La tendance indique que les acheteurs sont toujours en contrôle, mais le prix se rapproche maintenant d'une zone de résistance.

### **📊 Points clés**

* **Tendance :** Haussière, avec des bougies ascendantes dominantes

* **Zone de support :** **0,14 $ – 0,16 $**

* **Niveau de résistance :** **0,20 $**

* **Sentiment :** Positif, les acheteurs maintiennent leur force

$GIGGLE

#giggle #GiggleAcademy #BinanceBlockchainWeek #WriteToEarnUpgrade #CryptoRally

$GIGGLE montre **une forte dynamique haussière**, avec des sommets de plus en plus élevés se formant de manière cohérente. La tendance indique que les acheteurs sont toujours en contrôle, mais le prix se rapproche maintenant d'une zone de résistance.

### **📊 Points clés**

* **Tendance :** Haussière, avec des bougies ascendantes dominantes

* **Zone de support :** **0,14 $ – 0,16 $**

* **Niveau de résistance :** **0,20 $**

* **Sentiment :** Positif, les acheteurs maintiennent leur force

$GIGGLE

#giggle #GiggleAcademy #BinanceBlockchainWeek #WriteToEarnUpgrade #CryptoRally

Bitcoin Latest Analysis (Short & Simple)**

$BTC is currently showing **strong bullish momentum**, but price is slowing down near resistance.

### **Key Highlights**

* **Trend:** BTC remains in an overall **uptrend**, with higher highs recently formed.

* **Support Zone:** **$45,000 – $46,000** (buyers likely to step in).

* **Resistance Zone:** Around **$48,500**, where sellers are active.

* **Market Sentiment:** Still **positive**, but with signs of short-term pullback.

The chart image above shows candlestick movement, resistance level, support zone, and moving average trending upward.

$BTC

#CPIWatch #BinanceBlockchainWeek #TrumpTariffs #BTC #BTC走势分析

$BTC is currently showing **strong bullish momentum**, but price is slowing down near resistance.

### **Key Highlights**

* **Trend:** BTC remains in an overall **uptrend**, with higher highs recently formed.

* **Support Zone:** **$45,000 – $46,000** (buyers likely to step in).

* **Resistance Zone:** Around **$48,500**, where sellers are active.

* **Market Sentiment:** Still **positive**, but with signs of short-term pullback.

The chart image above shows candlestick movement, resistance level, support zone, and moving average trending upward.

$BTC

#CPIWatch #BinanceBlockchainWeek #TrumpTariffs #BTC #BTC走势分析

$SOL Solana (SOL) — Latest Short Analysis

SOL is currently trading near $137–140, within a consolidation range between roughly $131.80 (support) and $144–145 (resistance).

CoinCodex

+1

Market sentiment is mixed: some technical indicators suggest a neutral-to-bearish bias, with about 83% of signals bearish in the near term.

CoinCodex

On the bullish side — ongoing network upgrades and growing institutional interest could push SOL higher.

CoinMarketCap

+1

According to some long-term forecasts (if positive catalysts align), SOL could aim for $275 by end-2025, and even $500+ by end-2029 — but these are based on broader adoption and ecosystem growth.

CoinDesk

+1

🔭 What to Watch

Key support zone: ~ $131–$132 — a drop below this could signal more downside.

Key resistance to break: ~ $145–$150 — a clear breakout may trigger bullish momentum.

Broader catalysts: Progress on network upgrades, institutional flows, and overall crypto-market sentiment.

$SOL

#solana #BinanceAlphaAlert #SolanaStrong #CryptoRally #FamilyOfficeCrypto

SOL is currently trading near $137–140, within a consolidation range between roughly $131.80 (support) and $144–145 (resistance).

CoinCodex

+1

Market sentiment is mixed: some technical indicators suggest a neutral-to-bearish bias, with about 83% of signals bearish in the near term.

CoinCodex

On the bullish side — ongoing network upgrades and growing institutional interest could push SOL higher.

CoinMarketCap

+1

According to some long-term forecasts (if positive catalysts align), SOL could aim for $275 by end-2025, and even $500+ by end-2029 — but these are based on broader adoption and ecosystem growth.

CoinDesk

+1

🔭 What to Watch

Key support zone: ~ $131–$132 — a drop below this could signal more downside.

Key resistance to break: ~ $145–$150 — a clear breakout may trigger bullish momentum.

Broader catalysts: Progress on network upgrades, institutional flows, and overall crypto-market sentiment.

$SOL

#solana #BinanceAlphaAlert #SolanaStrong #CryptoRally #FamilyOfficeCrypto

$BTC Bitcoin (BTC) — Latest Quick Analysis

BTC is trading around ≈ $92,000–$94,000, holding just below recent resistance levels.

The Economic Times

+2

The Economic Times

+2

Technical outlook remains mixed: some analysts see consolidation between $90,000–$94,000 for now.

CoinCodex

+1

If BTC breaks above ≈ $94,500–$95,000, we could see a move toward $100,000–$110,000; but a drop below ≈ $90,000 might risk a slide toward $85,000–$87,500.

Coinpedia Fintech News

+1

Institutional interest and macro factors (e.g. interest-rate expectations, inflows) will play a big role in short-term price moves.

mint

+2

Reuters

+2

✅ What to watch this week:

Can BTC break above resistance near $94,500–$95,000?

Will macroeconomic signals (e.g. interest rates) push institutional flows?

Is support around $90,000 holding — a drop below might change the recent neutral / bullish bias

$BTC

#BTCVSGOLD #WriteToEarnUpgrade #BinanceBlockchainWeek #CPIWatch #BTC

BTC is trading around ≈ $92,000–$94,000, holding just below recent resistance levels.

The Economic Times

+2

The Economic Times

+2

Technical outlook remains mixed: some analysts see consolidation between $90,000–$94,000 for now.

CoinCodex

+1

If BTC breaks above ≈ $94,500–$95,000, we could see a move toward $100,000–$110,000; but a drop below ≈ $90,000 might risk a slide toward $85,000–$87,500.

Coinpedia Fintech News

+1

Institutional interest and macro factors (e.g. interest-rate expectations, inflows) will play a big role in short-term price moves.

mint

+2

Reuters

+2

✅ What to watch this week:

Can BTC break above resistance near $94,500–$95,000?

Will macroeconomic signals (e.g. interest rates) push institutional flows?

Is support around $90,000 holding — a drop below might change the recent neutral / bullish bias

$BTC

#BTCVSGOLD #WriteToEarnUpgrade #BinanceBlockchainWeek #CPIWatch #BTC

Bitcoin Latest Market Analysis (Short Update)

$BTC is showing mild short-term weakness, with price facing rejection from the upper resistance zone. Buyers are still trying to defend support, but momentum remains soft.

Key Levels:

Support Zone: $40,500 – $41,200

Resistance Zone: $45,000

Market Trend:

• Minor downtrend in the short term

• Long-term structure still bullish as long as major support holds

Market Sentiment:

Cautious but leaning positive overall.

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #TrumpTariffs #WriteToEarnUpgrade

$BTC is showing mild short-term weakness, with price facing rejection from the upper resistance zone. Buyers are still trying to defend support, but momentum remains soft.

Key Levels:

Support Zone: $40,500 – $41,200

Resistance Zone: $45,000

Market Trend:

• Minor downtrend in the short term

• Long-term structure still bullish as long as major support holds

Market Sentiment:

Cautious but leaning positive overall.

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #TrumpTariffs #WriteToEarnUpgrade

Bitcoin Latest Analysis (Short & Simple)**

$BTC is currently showing **bearish pressure**, with price pulling back after failing to hold recent highs. Sellers are slightly stronger, but BTC is still trading above major long-term support, which keeps the overall trend neutral-to-bullish.

### **Key Points:**

* **Trend:** Mild short-term downtrend

* **Support Zone:** $40,500 – $41,200

* **Resistance Zone:** $45,000

* **Market Sentiment:** Cautious but still bullish long-term

If Bitcoin holds above support, a bounce back toward $44,000–$45,000 is possible. A breakdown, however, may push it toward the $39,000 area.

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #CPIWatch #WriteToEarnUpgrade #TrumpTariffs

$BTC is currently showing **bearish pressure**, with price pulling back after failing to hold recent highs. Sellers are slightly stronger, but BTC is still trading above major long-term support, which keeps the overall trend neutral-to-bullish.

### **Key Points:**

* **Trend:** Mild short-term downtrend

* **Support Zone:** $40,500 – $41,200

* **Resistance Zone:** $45,000

* **Market Sentiment:** Cautious but still bullish long-term

If Bitcoin holds above support, a bounce back toward $44,000–$45,000 is possible. A breakdown, however, may push it toward the $39,000 area.

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #CPIWatch #WriteToEarnUpgrade #TrumpTariffs

# 🚨 **BeInCrypto Global — Market Update**

🚀 **Bitcoin (BTC) Surges as Market Shows Fresh Strength**

$BTC is showing renewed bullish momentum as buyers step back in after a period of consolidation. Market sentiment has improved, with traders eyeing a potential breakout if BTC holds above key support levels.

On-chain data also reflects decreasing exchange supply, hinting at accumulation from larger players.

📊 **Key Levels to Watch:**

• **Support:** $39,000–$40,000

• **Resistance:** $45,000

• A breakout above resistance could fuel the next rally leg.

Stay tuned for more real-time market insights from $BeInCrypto Global**.

---

🚀 **Bitcoin (BTC) Surges as Market Shows Fresh Strength**

$BTC is showing renewed bullish momentum as buyers step back in after a period of consolidation. Market sentiment has improved, with traders eyeing a potential breakout if BTC holds above key support levels.

On-chain data also reflects decreasing exchange supply, hinting at accumulation from larger players.

📊 **Key Levels to Watch:**

• **Support:** $39,000–$40,000

• **Resistance:** $45,000

• A breakout above resistance could fuel the next rally leg.

Stay tuned for more real-time market insights from $BeInCrypto Global**.

---

# 🔍 **Bitcoin (BTC) — Analyse récente courte**

$BTC is se négocie près d'une zone de support clé.**

Les acheteurs essaient de maintenir le marché au-dessus du support majeur, tandis que les entrées d'ETF et l'activité sur la chaîne restent saines.

Une rupture au-dessus de la résistance pourrait déclencher un élan haussier, mais une chute en dessous du support pourrait conduire à une correction plus profonde.

---

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #BTC86kJPShock #BTC #WriteToEarnUpgrade

$BTC is se négocie près d'une zone de support clé.**

Les acheteurs essaient de maintenir le marché au-dessus du support majeur, tandis que les entrées d'ETF et l'activité sur la chaîne restent saines.

Une rupture au-dessus de la résistance pourrait déclencher un élan haussier, mais une chute en dessous du support pourrait conduire à une correction plus profonde.

---

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #BTC86kJPShock #BTC #WriteToEarnUpgrade

Analyse la plus récente de Bitcoin (Courte & Simple)**

$BTC est actuellement en **pression baissière**, avec un recul des prix après avoir échoué à maintenir les récents sommets. Les vendeurs sont légèrement plus forts, mais le BTC se négocie toujours au-dessus du support majeur à long terme, ce qui maintient la tendance générale neutre à haussière.

### **Points clés :**

* **Tendance :** Légère tendance baissière à court terme

* **Zone de support :** 40 500 $ – 41 200 $

* **Zone de résistance :** 45 000 $

* **Sentiment du marché :** Prudent mais toujours haussier à long terme

Si Bitcoin reste au-dessus du support, un rebond vers 44 000 $–45 000 $ est possible. Une rupture, cependant, pourrait le pousser vers la zone de 39 000 $.

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #BTC86kJPShock #BTC #BTC走势分析

$BTC est actuellement en **pression baissière**, avec un recul des prix après avoir échoué à maintenir les récents sommets. Les vendeurs sont légèrement plus forts, mais le BTC se négocie toujours au-dessus du support majeur à long terme, ce qui maintient la tendance générale neutre à haussière.

### **Points clés :**

* **Tendance :** Légère tendance baissière à court terme

* **Zone de support :** 40 500 $ – 41 200 $

* **Zone de résistance :** 45 000 $

* **Sentiment du marché :** Prudent mais toujours haussier à long terme

Si Bitcoin reste au-dessus du support, un rebond vers 44 000 $–45 000 $ est possible. Une rupture, cependant, pourrait le pousser vers la zone de 39 000 $.

$BTC

#BTCVSGOLD #BinanceBlockchainWeek #BTC86kJPShock #BTC #BTC走势分析

## **🔍 Bitcoin Latest Market Analysis (Short & Clear)**

$BTC is holding strong above key support, showing continued bullish strength as buyers remain active. Price action suggests momentum may push BTC toward a new local high if volume continues to rise. However, resistance overhead could cause short-term pullbacks.

$BTC

#BinanceBlockchainWeek #BTC86kJPShock #IPOWave #BTC #TrumpTariffs

$BTC is holding strong above key support, showing continued bullish strength as buyers remain active. Price action suggests momentum may push BTC toward a new local high if volume continues to rise. However, resistance overhead could cause short-term pullbacks.

$BTC

#BinanceBlockchainWeek #BTC86kJPShock #IPOWave #BTC #TrumpTariffs

(BTC) – Latest Short Analysis**

$BTC is currently showing **strong bullish momentum**, holding above key support levels as buyers continue to dominate the market. Price action suggests that BTC is preparing for another attempt toward the **recent highs**, supported by increasing trading volume and improved market sentiment.

If Bitcoin maintains support above the **short-term moving averages**, it could push toward the next resistance zone. However, a break below support may trigger a short-term pullback.

Below is a picture-style visual market overview for Bitcoin:

$BTC

#BTC86kJPShock #BTCRebound90kNext? #BinanceHODLerAT #BTC #CPIWatch

$BTC is currently showing **strong bullish momentum**, holding above key support levels as buyers continue to dominate the market. Price action suggests that BTC is preparing for another attempt toward the **recent highs**, supported by increasing trading volume and improved market sentiment.

If Bitcoin maintains support above the **short-term moving averages**, it could push toward the next resistance zone. However, a break below support may trigger a short-term pullback.

Below is a picture-style visual market overview for Bitcoin:

$BTC

#BTC86kJPShock #BTCRebound90kNext? #BinanceHODLerAT #BTC #CPIWatch

Connectez-vous pour découvrir d’autres contenus