xStocks are tokenized versions of real U.S. stocks & ETFs — like Apple or NVIDIA — issued on blockchain (mostly Solana) and fully backed 1:1 by underlying shares held by custodians. They trade 24/7, offer fractional ownership, and can be used in DeFi applications. �

AInvest +1

📊 Current Market Signals

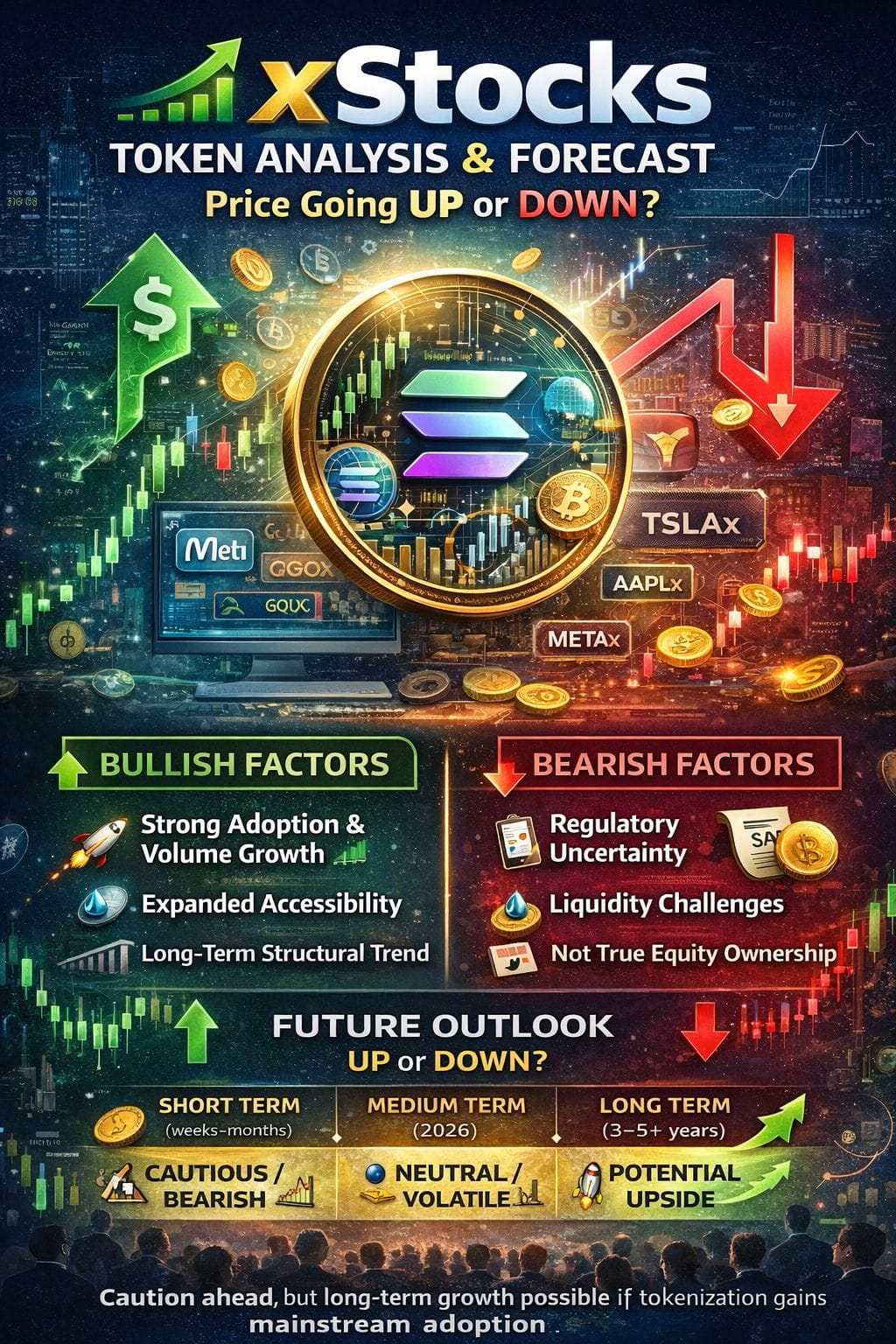

🟢 Bullish Factors

Strong adoption & volume growth

xStocks have seen hundreds of millions to billions in cumulative trading volume soon after launch, showing real demand for tokenized equities. �

AInvest +1

Expanded accessibility

Listings on major exchanges (Kraken, Bybit) + integrations with DeFi protocols increase liquidity and real-world use cases. �

Long-term structural trend

Tokenization bridges traditional assets and Web3 finance, attracting investors seeking global access and DeFi features. �

Quicknode Blog

🔴 Bearish & Risk Factors

Regulatory uncertainty

Tokenized stocks exist in a legal gray area in many regions. Regulatory pushback could restrict offerings, delist tokens, or impose compliance barriers. �

Reuters

Liquidity challenges

Some markets for certain xStocks remain thin, leading to wide price fluctuations and slippage in trades. �

CoinMarketCap

Not true equity ownership

You don’t get shareholder rights (voting/dividends directly) — only price exposure — which can limit institutional capital inflows. �

AInvest

📉 Price Predictions: Mixed Signals

Short-to-medium term

Some algorithmic forecasts for individual tokenized stocks (e.g., Coinbase xStock / COINX) show possible downward or sideways movement in 2025–mid-2026 before any breakout — indicating short-term bearish sentiment. �

CoinCodex

Technical metrics for COINX recently showed bearish momentum with prices trading below key moving averages. �

CoinMarketCap

Longer term (2026+)

As Regulatory clarity improves and adoption increases, niche forecasts see the potential for significant upside over multiple years if tokenization becomes mainstream — but likely tied to the underlying stock performance and broader market trends. �

CoinCodex

🧠 What This Means

Short Term (weeks–months):

➡️ Cautious/Bearish bias — investor sentiment and technical trends show upside limited or downward pressure for some tokens.

Medium Term (2026):

➡️ Neutral-to-Volatile — depends on regulatory clarity, liquidity improvements, and broader crypto market direction.

Long Term (3–5+ years):

➡️ Potential Upside — if tokenization becomes widely adopted and integrated into DeFi + TradFi systems, the concept could see structural growth, not just speculation.

🟡 Quick Take Summary

📈 Fundamentals: Strong innovation, real backing, DeFi integration.

📉 Risks: Regulation, liquidity, and structural volatility.

🗓 Outlook:

Short term: Likely flat/down or choppy

Mid term: Depends on adoption & rules

Long term: Growth possible if tokenized stocks gain global traction