In January 2026, the contrast between XRP and Celestia (TIA) highlights a divide between "Institutional Legacy" and "Modular Infrastructure." While XRP is battling through a macro-induced correction, TIA is attempting to find a structural bottom after a massive re-pricing cycle.

1. XRP Analysis: The ETF Battleground

XRP is currently the focus of intense institutional interest, but its price action is caught in a tug-of-war between spot demand and macro liquidations.

Market Sentiment: Bearish-Consolidating. XRP is trading near $1.89, down significantly from its early January peak of $2.40.

Key Drivers:

ETF Inflows: Spot XRP ETFs have recorded over $1.3 billion in cumulative inflows since their late 2025 debut, providing a "bid" that prevents a total collapse.

Macro Flush-out: Recent "flash crashes" in the broader market (Jan 19-21) triggered $40M+ in liquidations, pushing XRP below its 50-day EMA.

Technical Outlook: XRP is testing the $1.85 support. If it holds, a recovery toward $2.14 is likely; however, a break below could see it slide to the "ultimate floor" near $1.61.

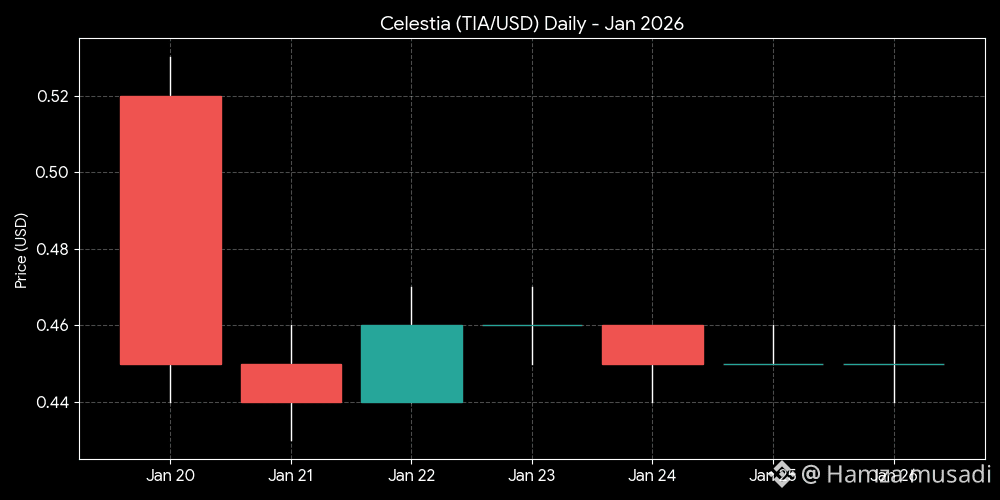

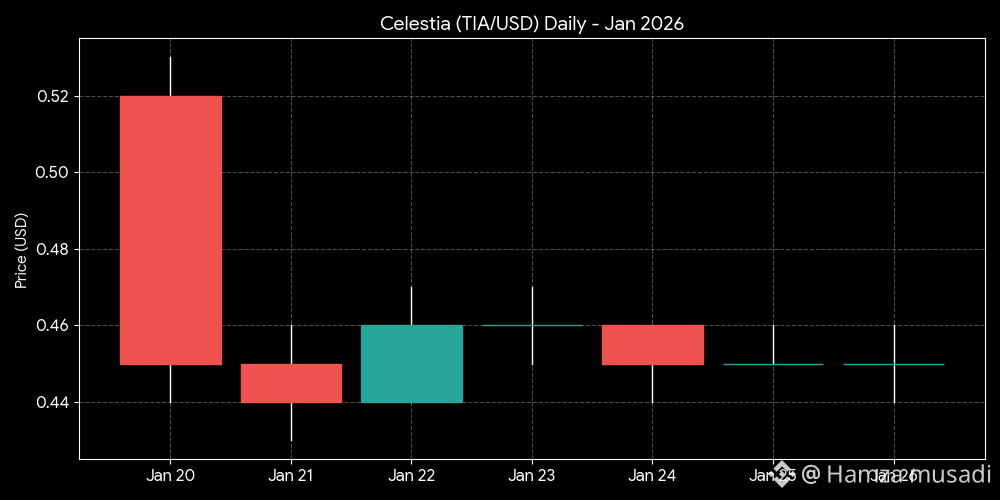

2. Celestia (TIA) Analysis: The "Modular" Reset

TIA is in a "repair phase." After a 90% drop from its 2024 all-time highs, it is finally showing signs of interest from "Smart Money" at these depressed levels.

Market Sentiment: Neutral/Boring. TIA is trading at approximately $0.45, hovering near its "cost-of-attention" floor.

Key Drivers:

Fibre Blockspace: The January 13 launch of "Fibre" (a 1Tb/s data protocol) has established Celestia as the undisputed king of throughput, though this hasn't yet translated to token price.

Inflation Reduction: The recent "Matcha" upgrade cut token issuance in half, reducing the constant sell-pressure from stakers.

Technical Outlook: TIA is moving within a descending channel. It is searching for a local bottom between $0.42 and $0.45. A breakout above $0.63 is required to confirm a trend reversal.

#FedWatch #GrayscaleBNBETFFiling #USIranMarketImpact #ETHMarketWatch #WEFDavos2026