The Alpha section on Binance highlights newly trending and high-activity tokens. These coins often show extreme price movements in a short period of time, making them attractive but risky. For an investor, the key is not excitement, but structure, capital protection, and timing.

1. Market Behavior of Alpha Coins

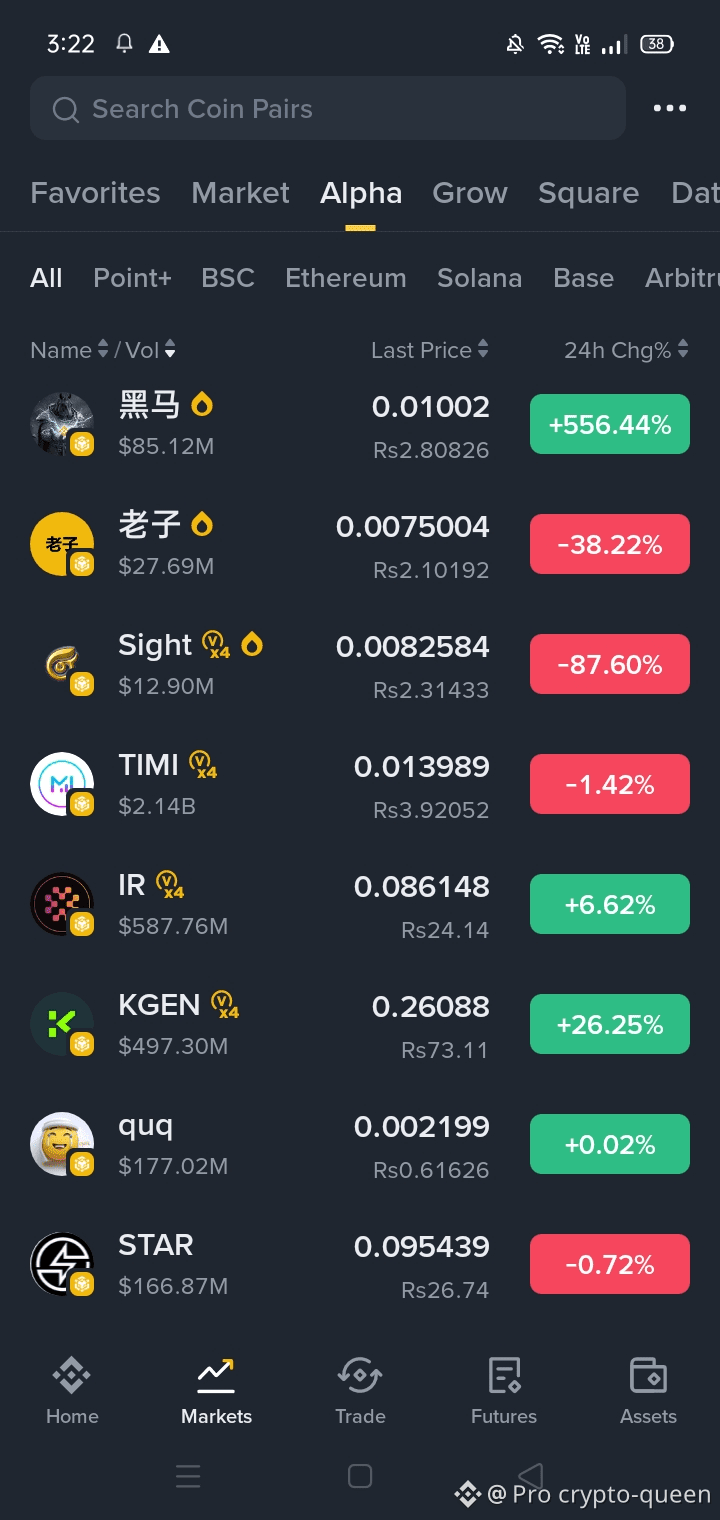

From the data visible, Alpha coins are showing very high volatility:

Some tokens are up 300%–500%+ in 24 hours

Others are down 30%–80% in the same timeframe

This tells us one thing clearly:

👉 Alpha coins are momentum-driven, not value-driven (yet).

They move primarily due to:

Speculation and hype

Short-term liquidity inflows

Early-stage narratives

Social attention and whale activity

These are not stable investments like BTC or ETH. They are early-phase assets.

2. Understanding the Pumps

Coins showing massive gains (e.g., +500%) are usually in the markup phase of a cycle:

Early buyers are taking profit

Late buyers are entering emotionally

Liquidity increases rapidly

For an investor, buying after a large green candle is statistically poor. Historically, such moves are often followed by:

Sharp pullbacks (30–60%)

Sideways consolidation

Or complete trend reversals

✔ Smart investors wait for pullbacks, not breakouts driven by hype.

3. Understanding the Dumps

Coins showing heavy losses (-30% to -80%) are likely experiencing:

Profit-taking after a previous pump

Failed narratives

Weak demand at higher prices

However, a dump does not always mean a dead project. Investors should ask:

Is volume decreasing or stabilizing?

Is price finding a base?

Is selling pressure slowing down?

If price stabilizes with low volume, it can indicate accumulation, which may offer better risk-reward than chasing pumps.

4. Volume Is More Important Than Price

For Alpha coins, volume tells the real story:

Rising price + falling volume → weak move

Falling price + falling volume → selling exhaustion

Stable price + consistent volume → possible accumulation

As an investor, never ignore volume. It often leads price.

5. Risk Management Is Non-Negotiable

Alpha coins require strict rules:

Small position size (1–3% of portfolio per coin)

Always use a stop-loss

Never average down blindly

Never go all-in on a single Alpha token

These assets can drop 50% in hours. Capital preservation is more important than catching every pump.

6. Investor vs Trader Mindset

If you are an investor, not a scalper:

Focus on structure and consolidation

Avoid emotional entries

Let the market prove strength before committing more capital

Alpha coins can become strong long-term performers, but only after volatility cools down.

7. Practical Strategy for Alpha Coins

A disciplined investor approach:

Watch coins after big pumps — don’t chase

Let price retrace and consolidate

Enter only near support zones

Take partial profits early

Rotate capital, don’t marry positions

Final Thoughts

Alpha coins offer early opportunities, but they demand discipline, patience, and realism. Most participants lose money because they chase hype instead of structure.

The goal is not to catch every move —

The goal is to stay solvent, consistent, and calm.

Trade smart. Protect capital. Let the market come to you.