Over $19.5B in positions wiped out in 24 hours.

Even top 10 coins dropped 30–40%.

Altcoins? Most were down 70–90% in minutes.

Let’s break down what actually happened behind this crash, how it started, and how it spiraled 👇

The first signs came from major CEXs auto-liquidating collateral tied to cross-margined positions.

That means traders who used alts as collateral for leverage across multiple trades got wiped automatically once prices started dropping.

This was the first domino.

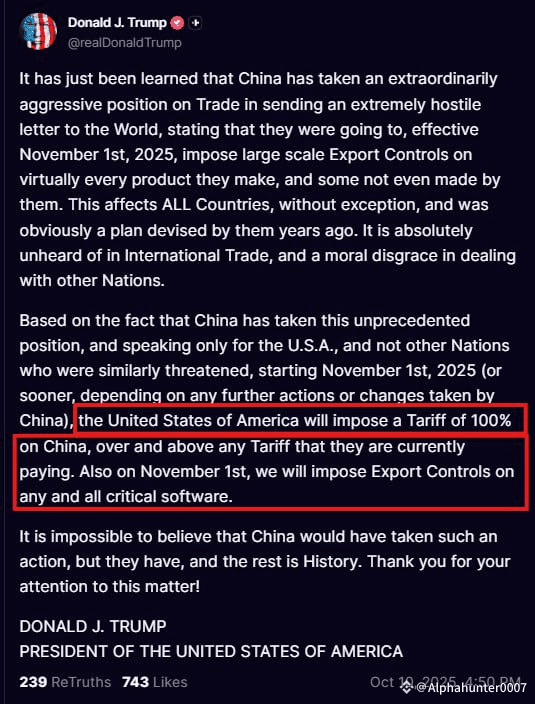

It all began after Trump’s tariff announcement.

Markets were already nervous after his Truth Social post about “massive tariffs on China.”

But when the official statement came which was 100% tariffs on all Chinese imports starting Nov 1, things escalated fast.

Stocks fell, the dollar spiked, and liquidity evaporated across all risk assets.

Then came the chain reaction.

As collateral value dropped, more positions hit margin calls.

Exchanges liquidated them to protect solvency.

Each forced sale pushed prices lower, causing even more liquidations.

Altcoins got hit the hardest because they had thinner order books and lower liquidity to absorb the selling.

Within an hour, BTC fell 13%, and alts collapsed 50–90%.

Coins like ATOM and AVAX went to near-zero for a few minutes.

Even stablecoin USDE depegged 35–40% as cross-margin positions tied to it blew up.

This wasn’t organic selling, it was a system-wide cascade.

As Jonathan said

When liquidity disappears, exchanges can’t liquidate positions normally.

Instead of closing trades through bids, they’re forced to use Auto-Deleveraging, wiping out both sides to keep the system solvent.

And that’s where it turned ugly.

During ADL, even winning traders (shorts) had their positions closed because the system couldn’t pay them out.

Perp markets are zero-sum.

If losers can’t pay, winners don’t get paid either.

So the exchange resets everyone to keep itself solvent.

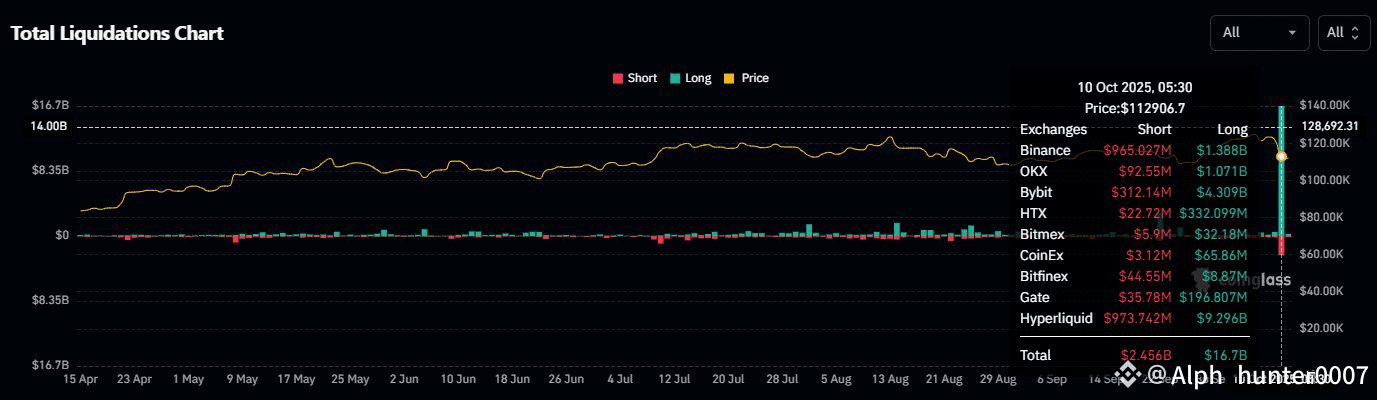

The total damage:

• $19.5B in crypto liquidations (24h)

• $65B in open interest wiped

• Nearly $1T erased from total market cap

• Billions in forced CEX sales

• Altcoins hit multi-year lows in minutes

This was the largest liquidation event ever,

17× bigger than COVID, 13× bigger than FTX.

What makes this crash different is how fast it unfolded.

Billions in open interest vanished in hours, not days.

This wasn’t panic, it was automation.

Risk systems triggered, code executed, leverage vanished.

Now the market’s stabilizing.

BTC is holding $111K–$112K.

ETH bounced over 12% from the lows.

DeFi remains intact.

CEXs are restoring liquidity.

But the over-leveraged traders are gone, for good.

Every bull cycle has one flush that resets the system.

March 2020 had it.

May 2021 had it.

This was October 2025’s flush.

A painful, but necessary reset before the next expansion.

So yes, it was brutal.

But it was also cleansing.

Leverage is gone.

Bad risk is wiped out.

And stronger hands are now in control.

This wasn’t the end,

it was the reset that clears the path for what comes next.