📊 Market Impact Explained

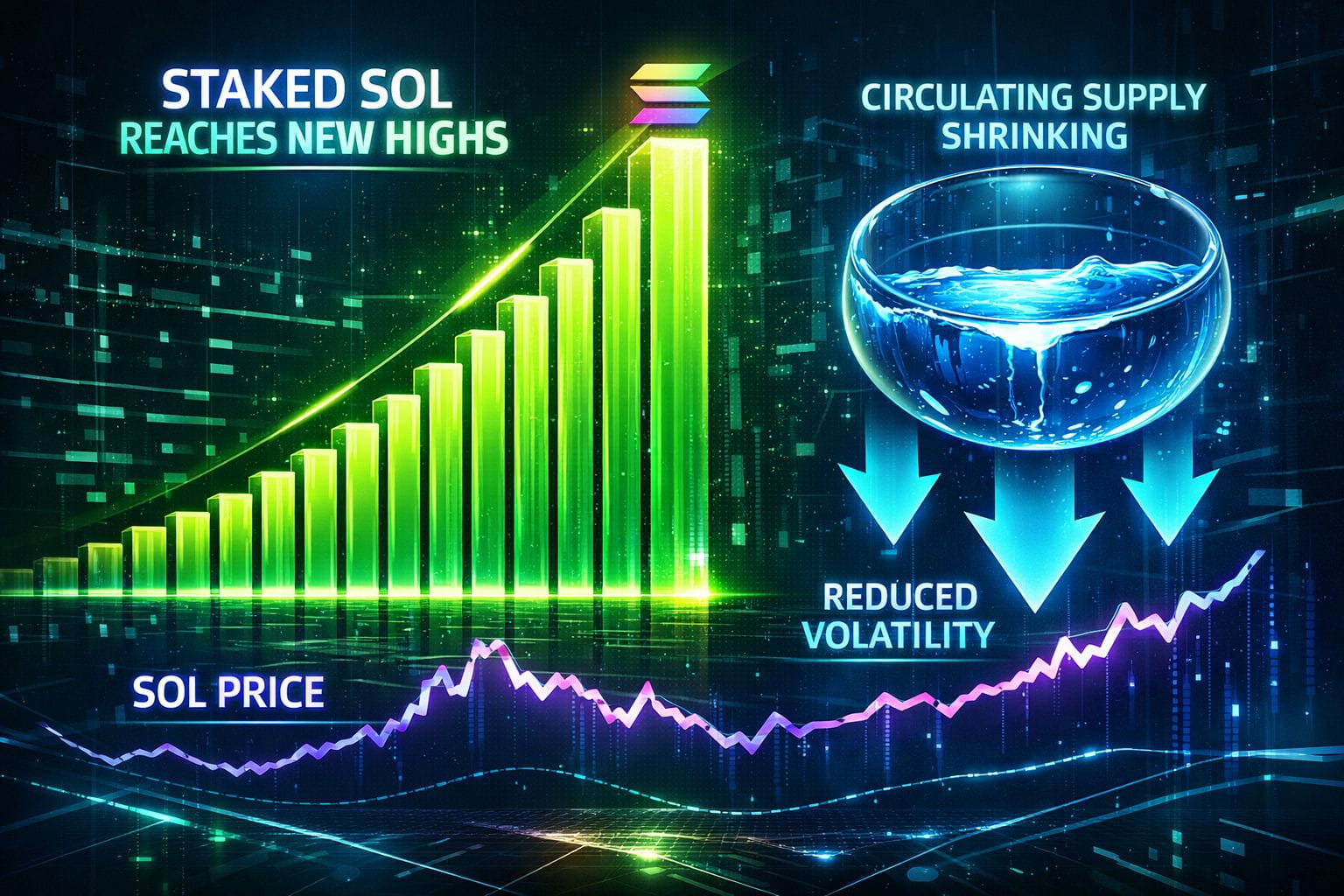

🔒 1) Unprecedented Lock‑up Reduces Circulating Supply

With ~70 % of SOL staked, a significant portion of the supply is effectively removed from active trading inventories, tightening near‑term available liquidity for price action. This dynamic supply contraction can reduce selling pressure and potentially limit downside volatility if broader market sentiment stabilizes

📈 2) Signal of Strong Holder Confidence

Investors are choosing to lock SOL despite recent price weakness — which suggests confidence in Solana’s long‑term fundamentals network growth, and ecosystem potential Historically, rising staking ratios have foreshadowed renewed accumulation phases when prices begin to recover

🧠 3) Broader Market Implications

This isn’t just a Solana story High staking participation can influence capital flows across markets

$BTC & $ETH traders may view strong staking metrics as a confidence proxy for crypto adoption

Institutional allocators increasingly favor assets with locked‑in stake economics — potentially improving risk‑adjusted yield comparisons

Derivative markets might price lower volatility expectations if supply rotation into staking persists

⚠️ Why This Matters Now

Most recent price action shows SOL trading substantially below prior highs even as broader crypto markets struggle. High staking levels during a price decline represent a contrarian, potentially bullish structural indicator, distinct from short‑term price narratives — and unlike pure technical signals, on‑chain staking reflects real capital commitment

⚠️ Disclaimer:

This summary highlights verified on‑chain staking data and interprets potential market implications. It is not financial advice and not a price prediction; market outcomes depend on multi‑factor dynamics including macro conditions and trader behavior#solana #staking #TrumpCancelsEUTariffThreat