Summary

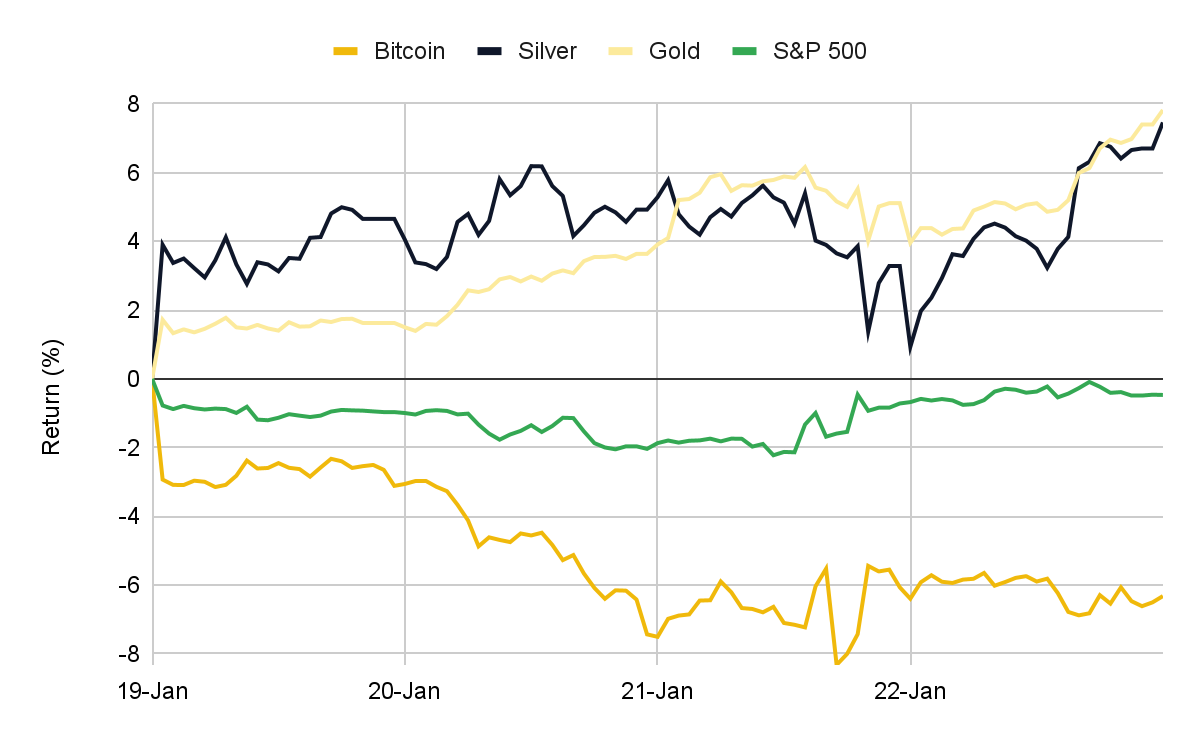

Geopolitical and tariff shocks briefly erased year-to-date (YTD) gains across BTC and equities, before a partial reversal following policy walk-backs under the TACO dynamic; however, the rebound remained uneven, with gold continuing to outperform risk assets and crypto lagging equities.

Stress in Japanese Government Bonds (JGBs) emerged as a key macro driver, with super-long JGB yields surging to record highs (JP30Y ~3.9%), pushing global borrowing costs higher and reinforcing tighter funding conditions that continue to weigh on BTC during risk-off episodes.

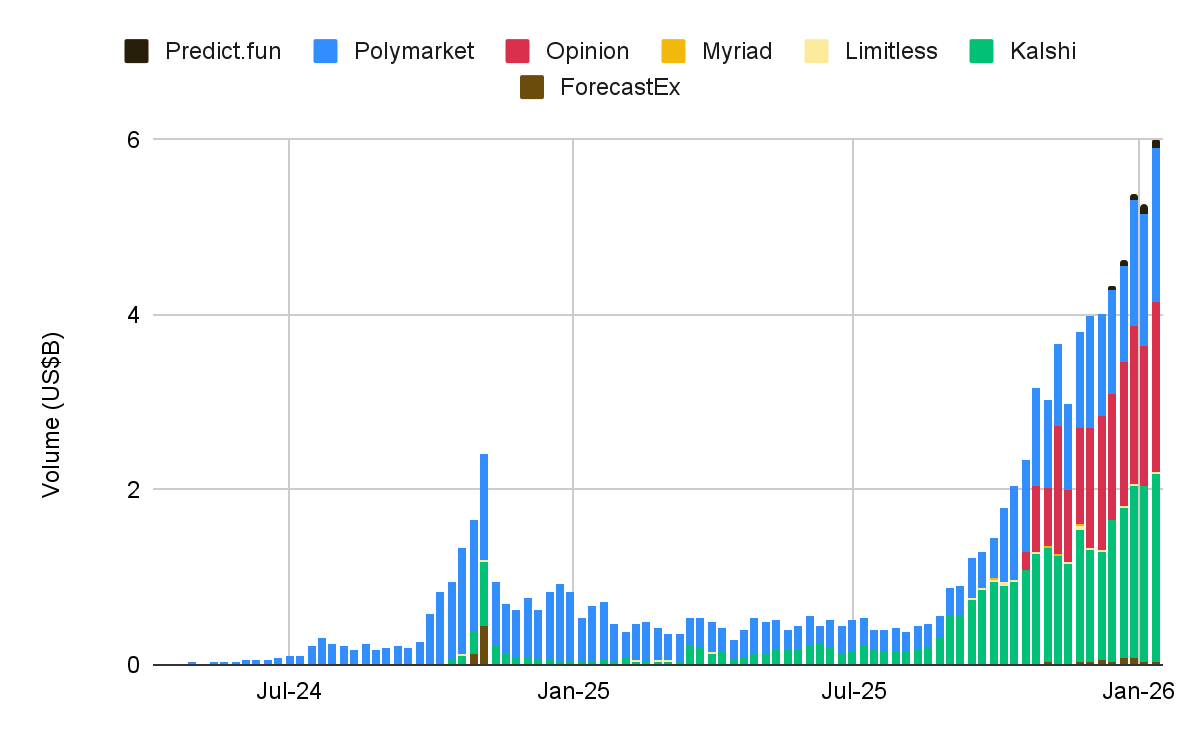

After rising more than nine-fold in 2025, prediction markets crossed a new milestone this week, with weekly notional volumes exceeding US$6B for the first time, as activity continues to broaden beyond single-event markets.

Market View

TACO Back On the Menu

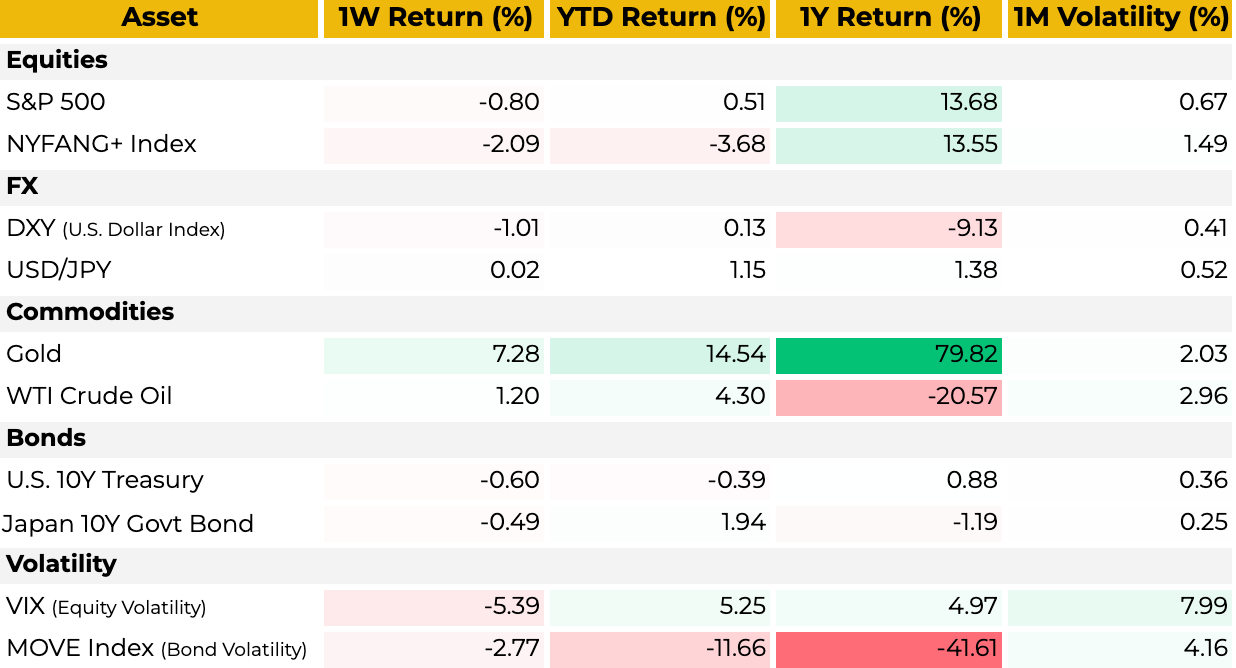

Markets were hit by geopolitical shocks this week, driven by developments around Greenland and a renewed trade-war narrative. Both BTC and equities briefly erased their YTD gains before rebounding after President Donald Trump softened his stance on tariffs, signaling that eight European countries would not move forward.

The reversal followed a familiar pattern, with the “TACO” trade (shorthand for Trump Always Chickens Out) returning to focus. Many investors continue to position for policy reversals, betting that hardline rhetoric is often walked back once negotiations, compromises, or agreements emerge. In practice, the TACO label reflects a pattern in which markets are quick to fade tariff-related shocks rather than price in a fixed long-term policy shift.

However, this episode points to a weaker version of the TACO trade: policy walk-backs helped limit further downside, but failed to trigger a full risk-on reversal, as caution remains evident across markets. Digital assets continue to lag broader markets including equities, while equities themselves are underperforming defensive assets such as gold, highlighting persistent risk sensitivity and uneven confidence across asset classes.

Figure 1: Recent tariff headlines triggered a risk-off move, followed by divergent asset performance

Source: TradingView, Binance Research, as of January 23, 2026

JGB Market Sell-Off

Japan's government bond (JGB) market triggered a significant global repricing of risk this week. A pronounced sell-off in Japanese long-duration bonds has pushed global borrowing costs higher, driven by evolving inflation expectations and ongoing fiscal concerns. Worries about potential expansive policy have added pressure to the country’s government debt, which already exceeds 250% of its GDP, one of the highest ratios in the world. Market volatility spiked as JP10Y rose sharply in a short period, while the JP30Y registered one of its largest daily increases since 2003, peaking at a new high of approximately 3.9%.

Figure 2: Japan's 30Y yield reaches new highs

Higher Japanese yields threaten to unwind a long-standing dynamic: the JGB carry trade. For years, Japan’s ultra-low rates suppressed global funding costs and enabled leverage into higher-beta assets, including crypto. While the BoJ has tolerated higher yields so far, its response has shifted toward liquidity management rather than yield suppression, implying less global liquidity support if bond market stress persists.

This matters for crypto because, as observed increasingly throughout 2025, BTC remains closely tied to global liquidity conditions. Sensitivity to funding conditions, policy expectations, and inflation dynamics has risen, tightening the link between macro shocks and crypto price action. In this backdrop, the first transmission channel is institutional positioning, particularly via ETFs. During macro stress, data shows that ETF flows tend to reflect de-risking quite early, with in this case, the largest daily outflow for the year being seen this week. As a result, crypto remains vulnerable in the near term when global risk appetite deteriorates. In the short term, this setup skews toward downside during risk-off episodes as tighter liquidity feeds directly into positioning and flows.

A notable cross-asset divergence has also emerged. Gold has absorbed the stress signal from rising Japanese yields, consistent with a regime where defensive and hedging demand dominate. By contrast, Bitcoin has remained inversely sensitive to JP10Y moves, indicating that BTC is reacting to tightening risk conditions rather than benefiting from them.

Figure 3: Weekly and yearly performance – crypto and global market assets

Over a longer horizon, however, BTC has historically stabilized once initial shocks are absorbed. If rising yields continue to challenge confidence in sovereign debt sustainability, BTC’s hedge narrative against fiscal or monetary stress could regain some relevance and support any potential recovery. Moreover, if market participants perceive credible actions that slow the stress signal in JGBs, such an inflection could also ease conditions for BTC.

In this context, Japan CPI and the BoJ policy decision on 23 January provided limited near-term relief to bond markets. The BoJ held policy rates at around 0.75%, in line with expectations, while maintaining a cautious, data-dependent stance. Guidance reinforced that policymakers remain focused on monitoring bond-market conditions, with particular attention on (i) tolerance for further yield volatility and (ii) the threshold for financial-stability intervention, amid elevated fiscal uncertainty and continued pressure at the super-long end of the JGB curve.

If volatility persists, the policy response is more likely to focus on stabilizing market functioning rather than returning to yield caps. In practice, this means authorities would aim to smooth price moves without reversing the broader normalization path. Measures could include limited or targeted JGB purchases, a slower pace of bond-purchase tapering, or a Japan-style “Operation Twist” designed to relieve pressure specifically at the super-long end of the curve. On the fiscal side, the MoF could also reduce issuance of super-long bonds, helping to ease supply pressures and improve market balance. A secondary catalyst would be domestic reallocation. Any signal that large domestic holders (e.g., pension flows) shift allocations toward JGBs would reinforce a repatriation theme, with spillovers into global rates and risk positioning.

Prediction Markets Enter a New Phase

Alongside stablecoins and tokenization, prediction markets are emerging as one of the key narratives for 2026. The sector has started the year strongly and continued to build momentum this week, reaching new highs in notional trading activity. Weekly prediction market volumes increased more than ninefold in 2025 to just under US$5B, before crossing a new milestone above US$6B this week. Notably, these figures do not fully capture all prediction-market-based models, suggesting underlying activity may be even larger.

Figure 4: Weekly prediction market notional volumes exceed US$6B for the first time

A key signal of maturation has been the broadening of activity across market types. How activity is spread across categories helps determine whether prediction markets are maturing into financial products — which require repeat participation and deeper liquidity — or remaining closer to speculative, casino-like offerings characterized by one-off volume spikes. Activity has steadily expanded across market types, supporting stronger overall liquidity dynamics. What began with election-based markets moved into sports categories, and in 2025 saw its fastest growth in non-sports segments such as economics, technology and science.

Second, broader public market acceptance, including interest from both users and institutions seeking integration, is expanding distribution channels and supporting regulatory progress. This trend is increasingly visible among TradFi players. Interactive Brokers (IBKR), for example, highlighted growing traction in its Q4 earnings call for ForecastX, the firm’s prediction market platform. ForecastX traded approximately 286M contract pairs during the quarter, up from 15M pairs in Q3. Interestingly, temperature-based contracts are currently the most actively traded, with further efforts underway to link these contracts to related markets such as electricity and natural gas.

Third, broadening competition is reshaping the market structure. What began with Polymarket has expanded to include several new competitors, including entrants from TradFi. This competitive landscape is driving differentiation pressures and encouraging activity to consolidate and formalize around emerging, specialized niches. Early examples include AI-integrated markets, impact markets, decision markets, and opinion markets (developments that collectively shift the focus from simply forecasting whether events occur to pricing what those outcomes imply). This evolution broadens the relevance of prediction markets for portfolio construction and decision-making, alongside research-driven curated markets and more varied betting and resolution mechanisms.

Looking ahead, continued growth in liquidity and volume remains the key focus. At the same time, this expansion is supporting the development of a more modular prediction market ecosystem, including regulated platforms, on- and off-chain protocols, integrations across a wider range of use cases and distribution channels, and increasingly AI-driven interfaces — all contributing to the maturation of the space.

The Week Ahead

From a regulatory perspective, the CLARITY Act is now likely to be delayed by several weeks as lawmakers shift focus toward housing-related legislation, offering little support to near-term sentiment. Developments here will be important to watch, as they are likely to shape near-term policy direction while also setting the broader tone for the year ahead.

On the macro front, the Fed will deliver its first rate decision of the year next week. The outcome is expected to be largely muted, with FedWatch assigning a greater than 95% probability to no rate cuts — a view that is already well priced by markets and consistent with recent data trends. The more important focus will be on Chair Powell’s commentary, particularly amid growing pressure from the Trump administration and questions around how policy guidance may evolve through the remainder of his tenure.

Attention is also turning to the eventual appointment of a new Fed Chair. Based on recent remarks, an announcement could be made as early as the coming weeks. While expectations broadly point toward a dovish successor, the degree of dovishness, rather than the direction alone, will be the key variable for markets to assess.

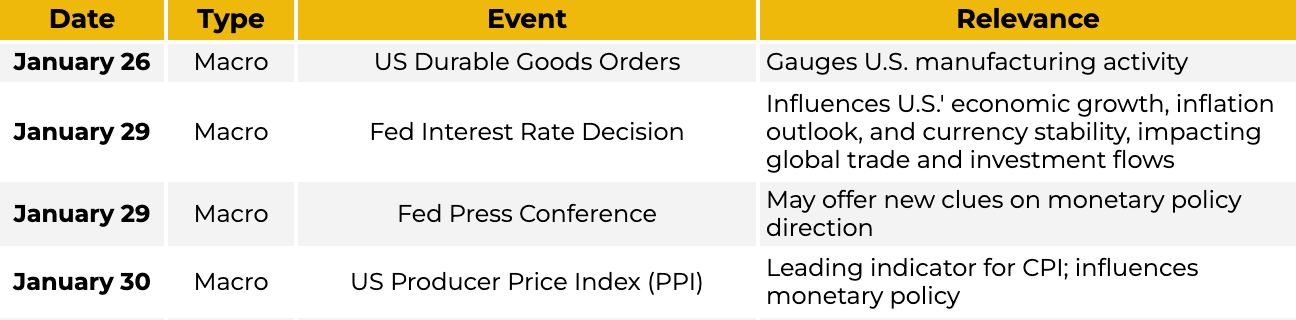

Figure 5: Key macro and crypto events for the week of January 23-30, 2026

Performance Snapshot

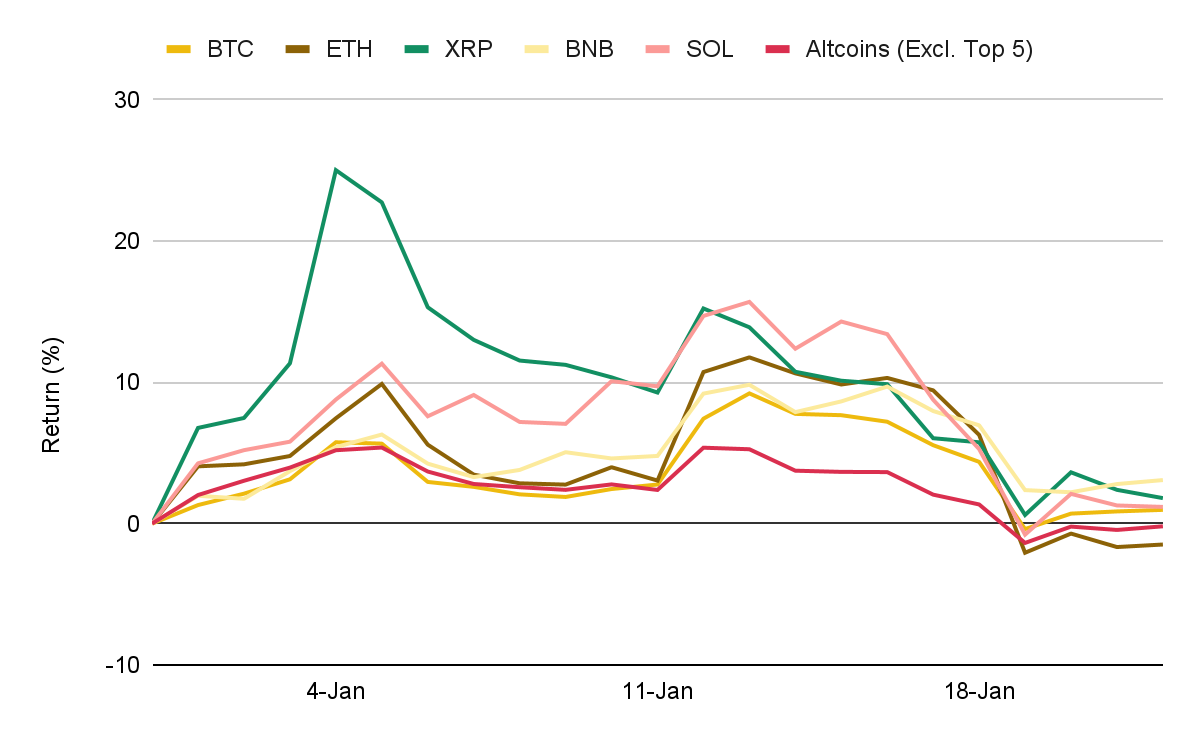

Figure 6: YTD indexed performance – major digital assets

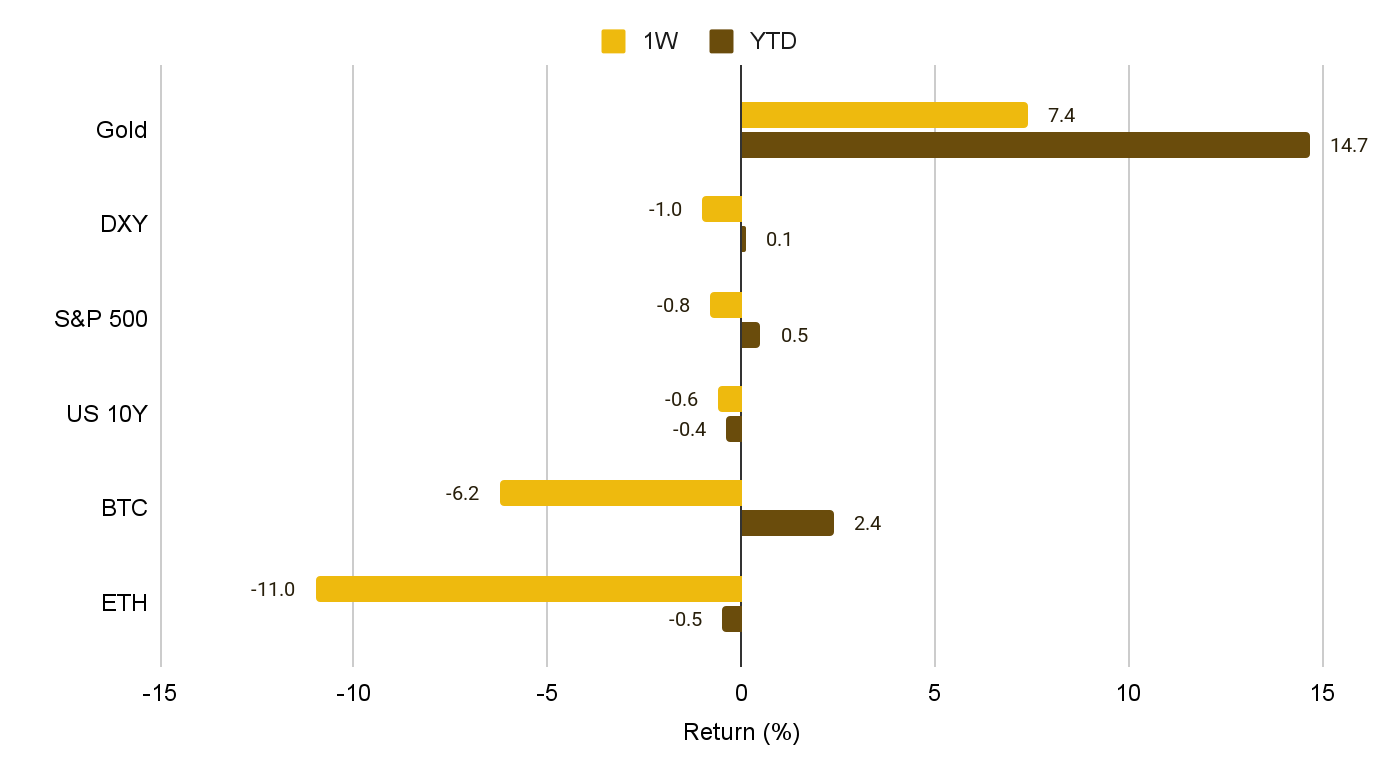

Figure 7: Multi-asset performance – equities, FX, commodities, bonds, volatility