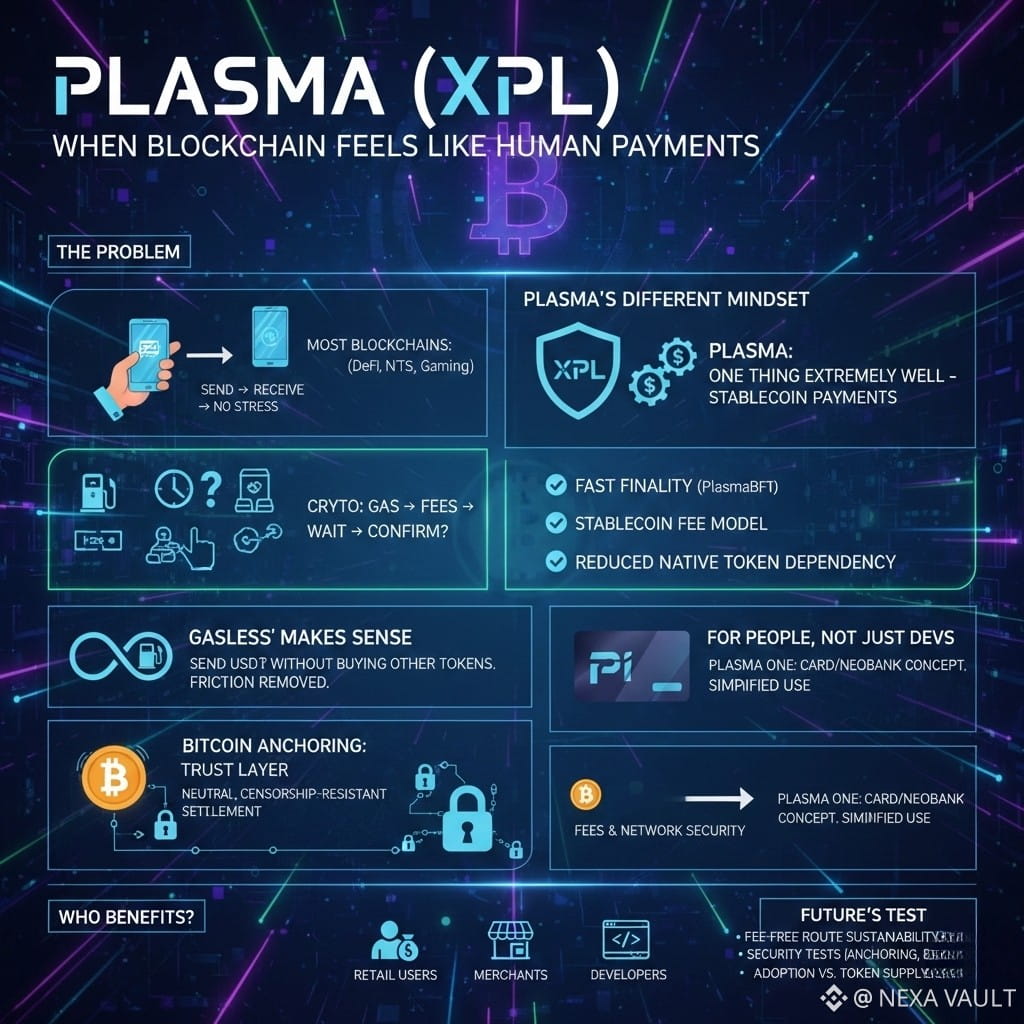

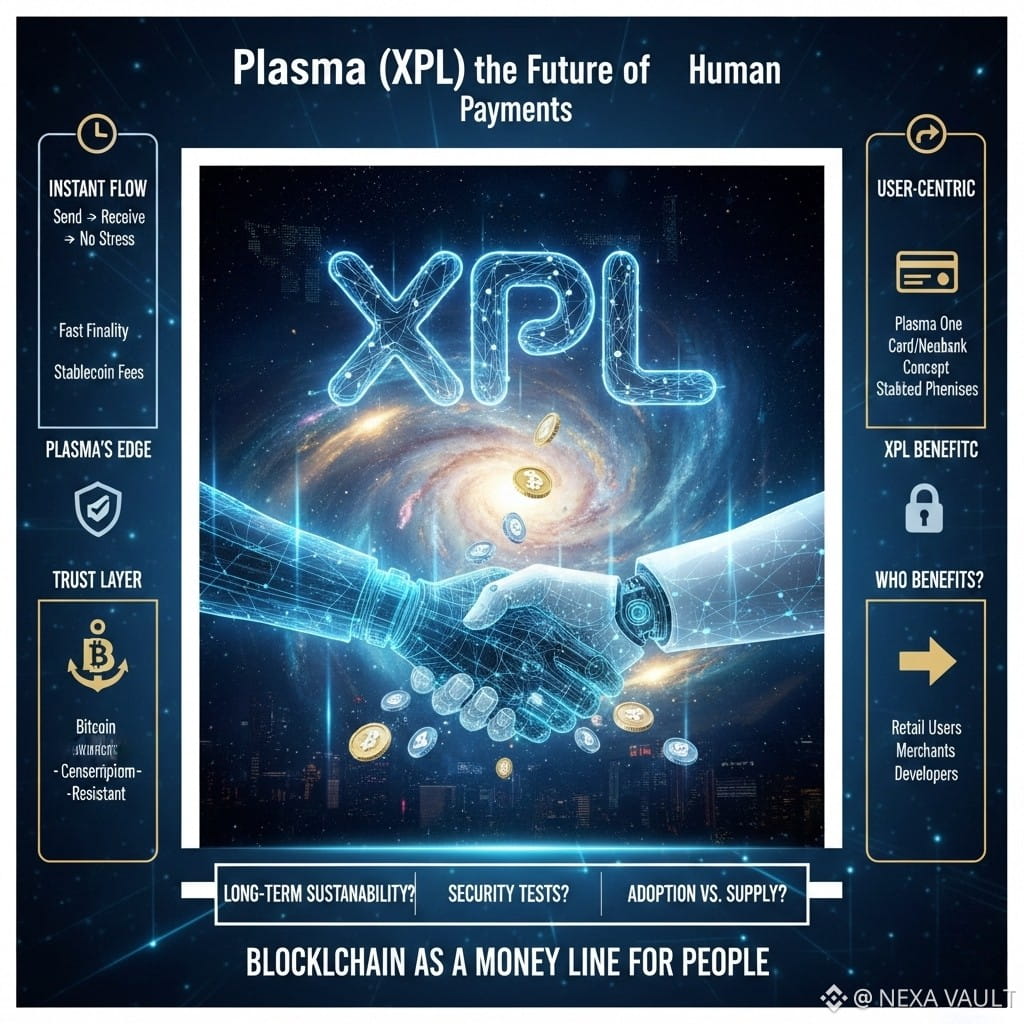

Think about sending money to a friend. You expect one simple flow:

send → they receive instantly → no extra stress.

But in crypto, what usually happens?

You buy a gas token first. You check network fees. You wait. You wonder if it’s confirmed.

This is where Plasma starts its thinking. If stablecoins are already being used for real payments around the world, why not design a chain specifically for them?

Plasma’s mindset is different

Most blockchains try to do everything: DeFi, NFTs, gaming, and more.

Plasma chose a different path: do one thing extremely well — stablecoin payments.

Even though it is EVM compatible, its design priorities are different:

Fast finality (PlasmaBFT) so payments feel like cash

A fee model centered around stablecoins

Reduced dependency on buying a native token just to send money

“Gasless” actually makes sense here

If you only want to send USD₮, why should you be forced to buy another token first?

Plasma’s design tries to remove this friction. It sounds like a small detail, but for new users, this is often the biggest barrier.

Bitcoin anchoring — the trust layer

A payments rail feels neutral only when it doesn’t appear captured by a single ecosystem. Plasma uses Bitcoin anchoring in its security narrative to signal neutral, censorship-resistant settlement.

Not just for developers

With ideas like Plasma One (card / neobank style concept), the team shows they want people to use stablecoins without understanding seed phrases or blockchain complexity.

The blockchain stays in the background. The payment experience comes to the front.

Understanding the role of XPL

XPL acts as the anchor for fees and network security.

This is a tricky balance when transfers are cheap or fee-free, so Plasma aligns incentives through staking and broader chain activity.

Plasma exists — this is not just a narrative

Public RPCs, chain IDs, explorers, and testnet/mainnet configurations are openly available. You can connect to the chain. This is a live environment, not just an idea on paper.

Who benefits?

Retail users → small payments become practical

Merchants → predictable, low-cost settlement

Developers → familiar EVM environment on a payment-optimized chain

What will decide Plasma’s future?

The long-term sustainability of fee-free routes

Real-world security tests of anchoring and bridging

Adoption growth versus token supply dynamics

These are the factors that will test Plasma over time.