As XRP continues gaining momentum in the crypto market, many investors are already asking the big question: How high can XRP really go before people start selling heavily?

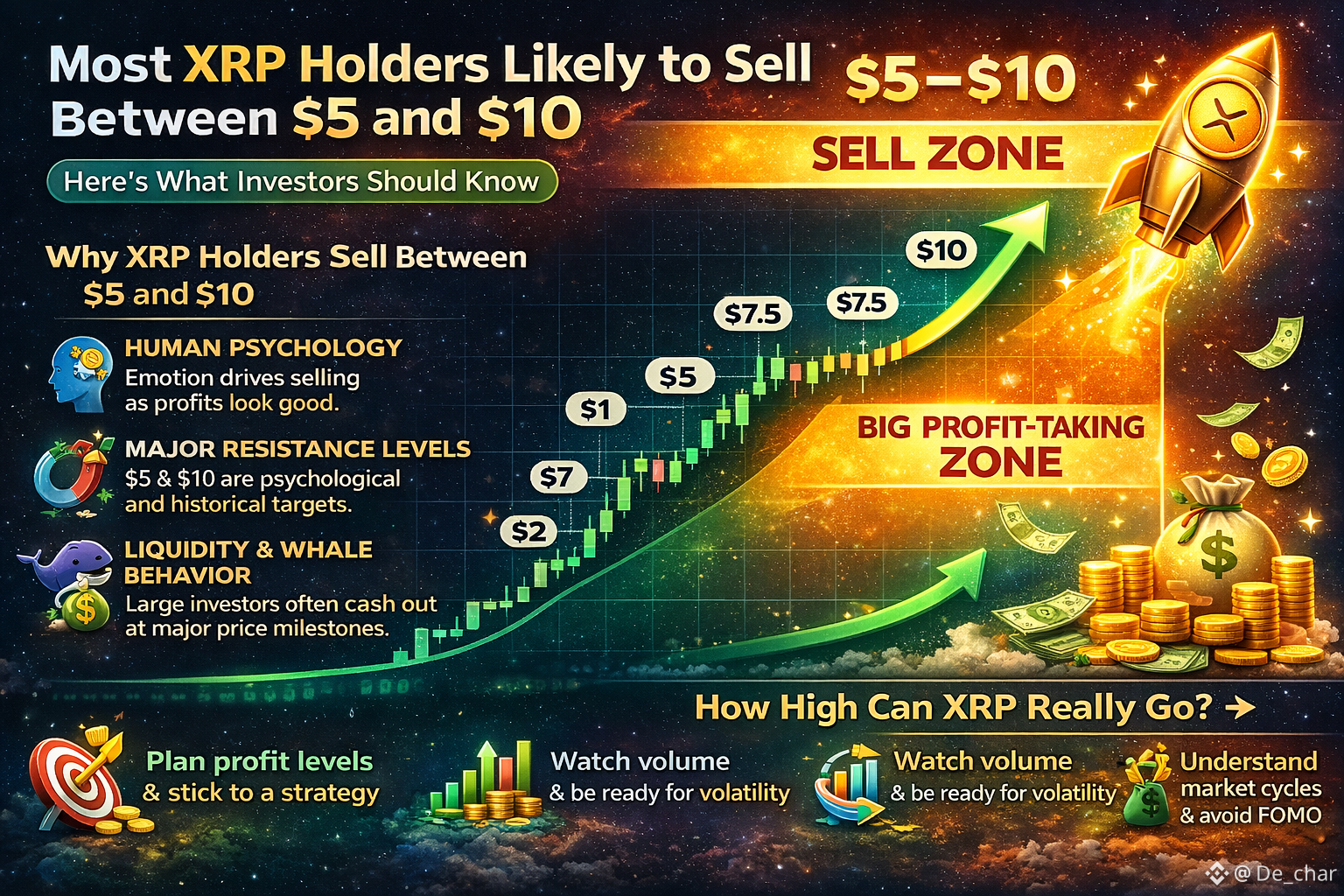

Market psychology, historical trading behavior, and liquidity dynamics suggest that a large percentage of XRP holders are likely to take profits between $5 and $10. This doesn’t mean XRP cannot go higher — but it does mean strong selling pressure should be expected in that zone.

Let’s break down the real story behind this potential sell-off and what it means for investors.

Why the $5–$10 Range Is a Major Profit-Taking Zone

🧠 Human Psychology Drives Selling

Many XRP investors accumulated their tokens at prices below $1. If XRP reaches $5 or more, early holders would be sitting on massive gains. At that point, emotions kick in — fear of losing profits, excitement, and the desire to secure financial freedom.

Most retail traders don’t wait for perfect tops. They sell when the profit feels “good enough.”

📈 Historical Resistance and Market Memory

Price levels act like memory zones in financial markets. When an asset approaches a psychologically significant price, traders anticipate heavy activity. Round numbers like $5 and $10 attract attention, limit orders, and profit-taking behavior.

Even long-term believers often reduce exposure when these milestones are reached.

💧 Liquidity and Whale Behavior

Large holders and institutional traders usually distribute their positions into strength. When volume increases around major price levels, whales often sell gradually rather than wait for a peak. This creates resistance and can slow or temporarily reverse price movement.

Does This Mean XRP Can’t Go Above $10?

Not at all. XRP could break higher if demand overwhelms supply. Strong catalysts such as regulatory clarity, real-world adoption, institutional partnerships, or broader crypto bull market momentum could push price beyond expectations.

However, traders should expect volatility, pullbacks, and consolidation in the $5–$10 zone before any sustained breakout attempt.

What Smart Investors Should Consider

✅ Plan Profit Levels in Advance

Instead of hoping for the perfect top, consider scaling out partial profits at predefined levels.

✅ Watch Volume and Momentum

Rising price with declining volume often signals exhaustion. Strong volume confirms continuation.

✅ Avoid Emotional Trading

FOMO and panic selling destroy consistency. Stick to a strategy.

✅ Understand Market Cycles

Crypto markets move in waves. Corrections are healthy and normal even in strong bull runs.

Final Thoughts

The $5–$10 price range is likely to become a major decision zone for XRP holders. Many investors will secure profits there, creating selling pressure and volatility. While XRP still has long-term potential, realistic expectations and disciplined planning will separate successful investors from emotional traders.

Smart money prepares for both opportunity and risk.