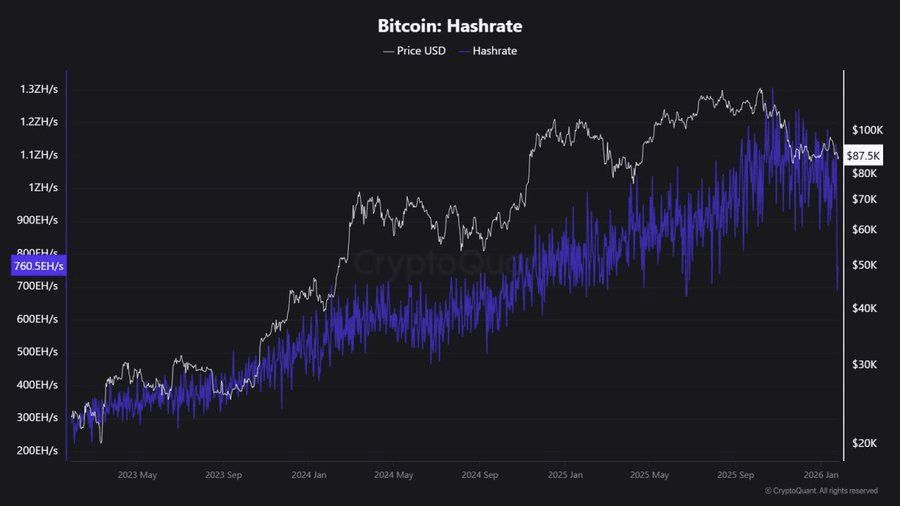

Recent data indicates a decrease in the hash rate of the Bitcoin network by about 32% in just 3 days.

🔎 What is the reason?

The decline is linked to a partial halt in mining operations in the United States due to a strong winter storm that affected power and operational infrastructure, not because of a malfunction in the network itself.

⚠️ Important point:

This decline is operational and not structural

▪️ The mining farms did not leave the network permanently

▪️ The temporary decline is due to external conditions

▪️ Mining capacity historically returns quickly and stronger after conditions stabilize

📊 Historical behavior is clear:

Any sharp drop in the hash rate is short-term, and conversely shows the resilience of the Bitcoin network and its ability to adapt to shocks.

💡 More importantly:

The price did not collapse with the drop in hash rate,

and this reflects the market's maturity and its ability to separate network security from temporary operational fluctuations.

🔗 From an On-Chain perspective:

The hash rate is a long-term confidence indicator,

As long as the overall trend is upward, these pullbacks are just temporal noise within a healthy path for the network.