At the time of writing, $BTC is trading near $78,000, and based on current market structure, liquidity positioning, and technical confluence, the probability favors a short-term corrective move toward the $71k–$72k region before any sustainable upside continuation.

This is not a random level. It is a structurally important zone.

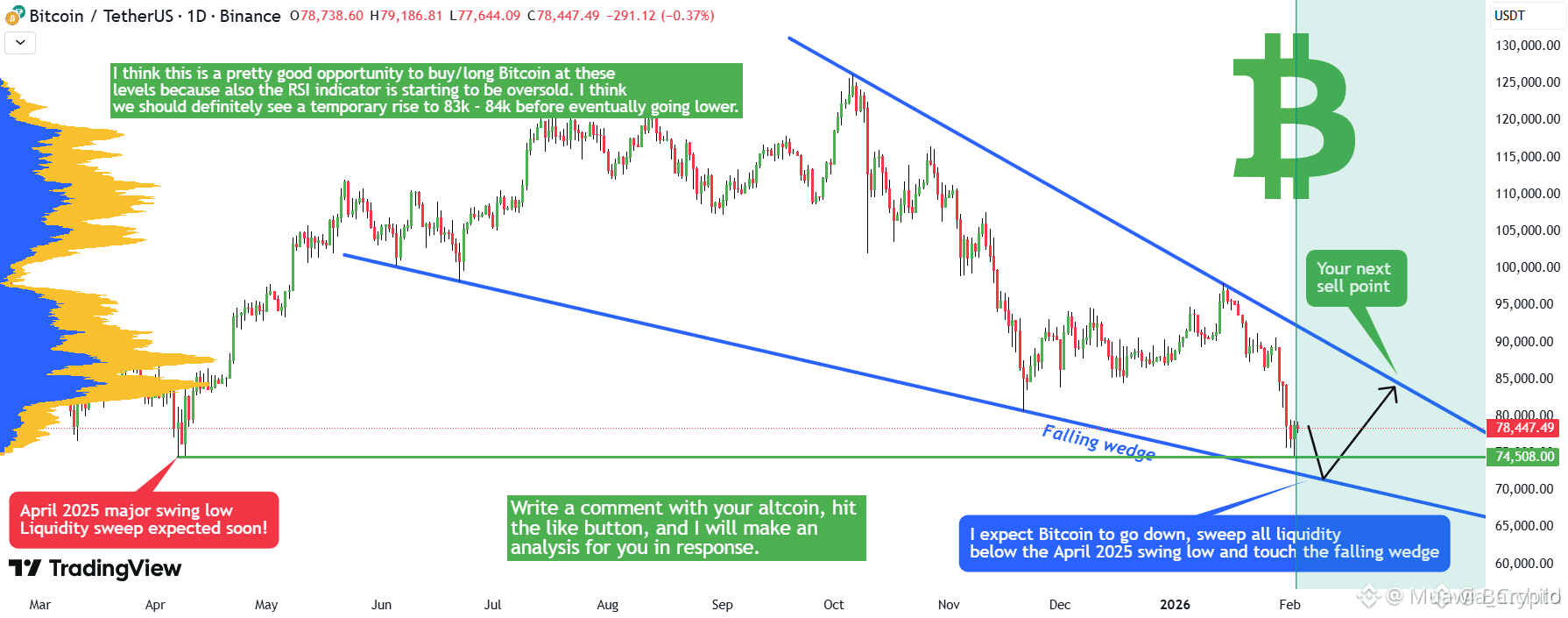

🧠 1. Unresolved Liquidity Below the April 2025 Swing Low

Markets are driven by liquidity engineering, not emotions.

One of the most notable inefficiencies on the chart is that price has not yet swept liquidity resting below the April 2025 swing low. This area is highly significant because:

Retail traders commonly place stop losses below obvious swing lows

Algorithmic systems target clustered liquidity

Institutions accumulate positions where forced selling occurs

Historically, meaningful upside expansions in BTC often begin after downside liquidity has been cleared, not before. Until that pool is taken, upside breakouts remain structurally weaker.

In other words:

➡️ The market still has unfinished business below.

📐 2. Falling Wedge Structure & Technical Confluence

Price action is compressing within a downward-sloping falling wedge, a pattern typically associated with eventual bullish resolution — but only after final structural retests.

The projected support retest zone:

$71k–$72k

Why this region matters technically:

Aligns with the lower wedge boundary

Overlaps with prior demand reaction

Sits near high-liquidity stop clusters

Psychological round-number support

This creates a high-probability reaction zone, not just a random price guess.

📊 3. Momentum Behavior (RSI Context)

RSI is gradually approaching oversold territory on lower timeframes, signaling:

Seller momentum is expanding but nearing exhaustion

Risk/reward begins improving for longs if structure holds

Potential for a relief rally once liquidity is taken

Oversold RSI alone doesn’t reverse markets — but when combined with liquidity sweep + structural support, probabilities shift.

🔄 4. Expected Sequence (Probable Flow Model)

Based on current structure, the more logical market path is:

Step 1: Liquidity sweep into $71k–$72k

Step 2: Strong relief rebound toward $83k–$84k

Step 3: Decision point — breakout or rejection from wedge resistance

That rebound will be critical. If bulls cannot reclaim and hold higher structure, it increases the probability that the broader market is transitioning into a larger distribution phase rather than continuation.

⚠️ 5. Bigger Picture Risk

While the $72k region may offer a tactical long opportunity, it does not automatically imply cycle continuation.

Later in the year, if macro liquidity tightens and risk markets weaken, Bitcoin could still revisit sub-$60k levels in a deeper corrective phase. Markets move in layers, not straight lines.

🪙 Altcoins Outlook

I’m not favoring aggressive altcoin exposure right now.

Why:

Altcoins typically underperform during BTC structural uncertainty

Liquidity concentrates into majors first

Mid-term trend for alts still shows distribution characteristics

A more favorable accumulation window for alts may appear much later, when:

BTC volatility compresses

BTC dominance stabilizes

Risk appetite returns

Right now = selective, not aggressive.

🔍 Summary Plan

Short term:

➡️ Watch for a move into $71k–$72k

After sweep:

➡️ Potential rebound toward $83k–$84k

Bigger picture:

➡️ Structure later in the year could still allow deeper downside

This is a liquidity-driven map, not prediction hype. Price confirms, not opinions.

Disciplined trading isn’t about catching every move — it’s about understanding where the market is most likely to react and managing risk accordingly.

Stay patient. The best trades come from levels, not emotions. 📊#BTC