Introduction

Crypto trading today is no longer just about charts and indicators. More than ever, markets are driven by expectations, narratives, and macro events — ETFs, interest rates, elections, and regulation.

I recently came across Polymarket while following several high-hype market events. At first, I assumed it was just another prediction or betting platform. But after watching how it behaved during major moments that every trader was focused on, it became clear that Polymarket offers something different:

A transparent, real-time view of market belief — backed by capital, not opinions.

This article explains what Polymarket is, how it works, and why it has practical value for Binance traders, both from a trading and learning perspective.

What Is Polymarket?

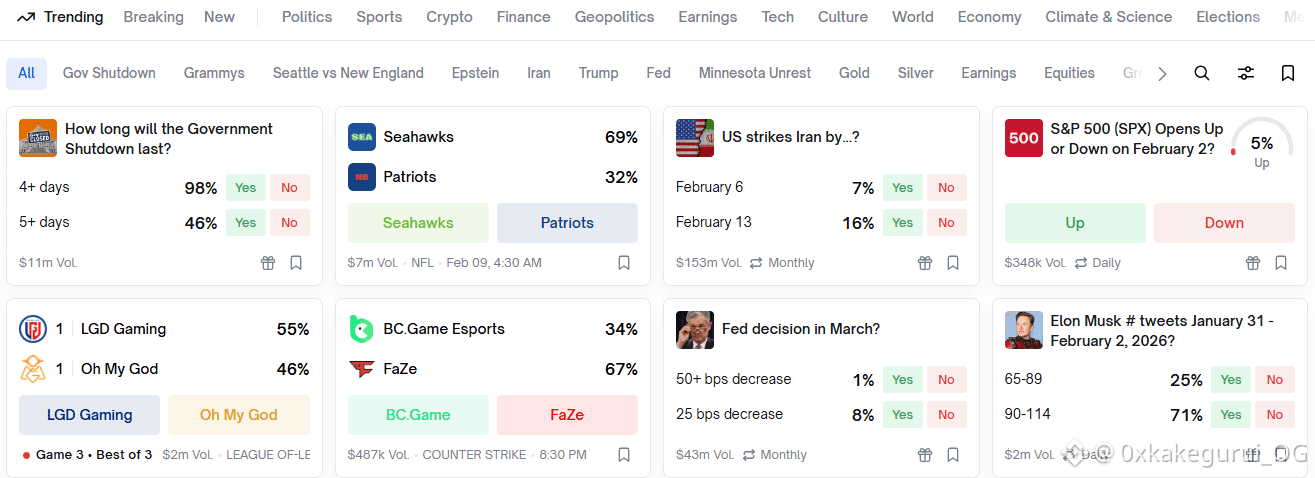

Polymarket is a decentralized prediction market where participants trade on the outcomes of real-world events.

Instead of price charts, users trade probabilities.

Markets ask clear, binary questions such as:

Will a Bitcoin spot ETF be approved?

Will ETH receive ETF approval this year?

Will the Federal Reserve cut interest rates?

Who will win the US presidential election?

Each outcome trades between $0 and $1, representing the market’s implied probability. Prices move continuously as new information enters the market.

What makes Polymarket especially valuable is that:

Participants commit real money

Outcomes are resolved objectively

Sentiment is expressed through positioning, not commentary

The Bitcoin Spot ETF Hype: When Expectations Were Already Maxed Out

The Bitcoin spot ETF approval was one of the first moments where Polymarket truly caught my attention.

In the days leading up to approval:

Crypto social media was extremely bullish

Many traders expected a strong breakout

Binance markets showed aggressive late positioning

However, Polymarket told a different story.

Approval odds were already extremely high and, more importantly, barely moved even as new headlines dropped. There was no late surge in probability, no sense of excitement — just quiet certainty.

That was an important signal.

Instead of chasing the move, I:

Reduced position size

Took profits earlier

Treated the event as a potential liquidity and “sell-the-news” moment

When approval finally happened and Bitcoin stalled, then pulled back, it confirmed what Polymarket had already shown: belief was fully priced in.

Polymarket didn’t predict price direction — it revealed expectation saturation.

Political Hype and Crypto Markets: Faster Belief Adjustment Than Price

Another set of moments that stood out involved US election-related headlines.

During major political events debates, court rulings, and breaking news — Polymarket repriced outcomes almost immediately. Probabilities adjusted within minutes.

At the same time:

Crypto prices often lagged

Market structure stayed choppy

Social narratives flipped repeatedly

Watching this play out reinforced an important lesson:

Markets often adjust belief before they adjust price.

This helped me avoid overtrading volatile, headline-driven chop and instead treat those periods with more patience and reduced exposure.

ETH ETF Speculation: The Difference Between Confidence and Hope

ETH ETF speculation provided another clear, real-world example of Polymarket’s usefulness.

During several rumor-driven rallies:

ETH price surged

Market confidence appeared strong

Altcoins followed aggressively

But on Polymarket:

Approval odds remained uncertain

Probability moved gradually rather than explosively

Confidence never reached the near-certainty levels seen during the BTC ETF cycle

This discrepancy mattered.

It framed ETH moves as momentum-based trades, not high-conviction positions anchored to confirmed outcomes. When volatility increased and ETH retraced, Polymarket had already been signaling hesitation while hype was at its peak.

How Binance Traders Can Practically Use Polymarket

Polymarket is not a signal service and should not be treated as one. Its value lies in context.

Before entering macro or news-driven trades on Binance, traders can use Polymarket to ask:

Is this outcome already expected?

Are probabilities extreme or still evolving?

Is confidence crowded or uncertain?

Used alongside traditional tools — price action, volume, funding rates, and open interest — Polymarket can help traders:

Avoid chasing overextended narratives

Adjust leverage during hype-driven events

Improve timing around news releases

Learning Benefits: Training a Probability-Based Mindset

Even without placing trades, observing Polymarket has strong educational value.

It naturally trains traders to:

Think in probabilities instead of absolutes

Respect uncertainty

Separate belief from bias

This mindset carries directly into better:

Risk management

Position sizing

Emotional discipline during volatile periods

Polymarket and Binance: Complementary, Not Competing

Binance provides liquidity, execution, and market access

Polymarket provides insight into expectations and belief

Together, they help traders understand both:

What the market is doing

What the market expects to happen next

That combination is especially powerful during hype-driven cycles.

Final Thoughts

Polymarket will not replace technical analysis, fundamentals, or proper risk management. But in a market increasingly shaped by macro narratives and headline-driven volatility, understanding expectations is critical.

Since discovering Polymarket, it has become a quiet reference point in my trading process not for entries, but for perspective.

In trading, price moves on surprise.

Polymarket helps reveal where surprise is already gone.

And that alone can be an edge.