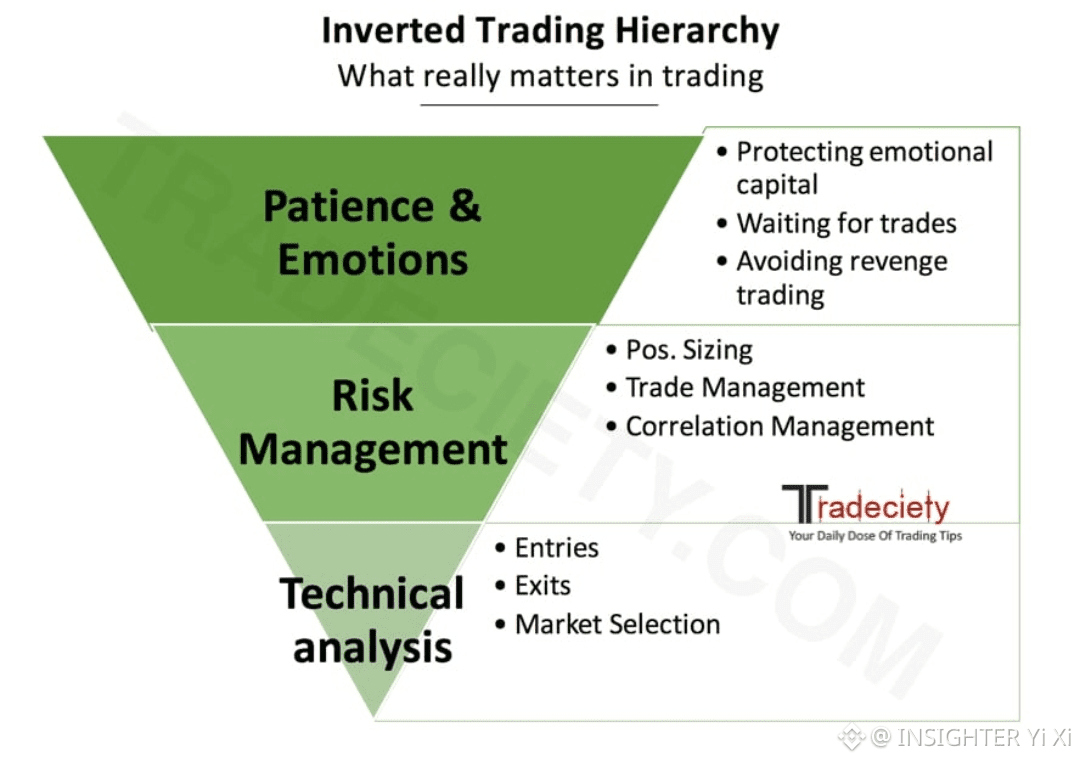

After years in the market, one hard truth becomes clear: most traders fail not because their entries are bad but because their capital management is rigid emotional and incomplete. Many people are taught that capital management simply means risking one or two percent per trade. That rule sounds safe, but real markets are not static, and real trading is not mechanical. True capital management is knowing when to defend, when to press and when to step aside completely.

The biggest shift happens when you stop treating all capital the same. Splitting capital into a safety portion and a learning or risk portion changes everything. The larger portion is used only for familiar markets and proven setups, with the goal of consistency and survival. The smaller portion is where experimentation happens. This approach allows growth without psychological pressure and learning without account destruction. It keeps mistakes small and lessons affordable.

Another misunderstood truth is time. More screen time does not equal better performance. In fact, excessive trading often leads to fatigue, poor decisions, and emotional losses. Limiting trading to specific windows forces selectivity. When the session ends, trading ends. This protects both capital and mental clarity, which are equally important in long-term success.

Profits also need structure. Many traders increase risk as soon as their balance grows, giving back gains to the market. Separating profits changes this dynamic. Locking in real gains and allocating only a portion for higher-risk opportunities keeps the core account stable while still allowing participation in strong momentum moves. Missing a trade no longer feels painful when capital is protected.

Losses are another area where most traders focus on the wrong metric. The most dangerous loss level is not a number on the screen, but a shift in behavior. Restlessness, revenge trading, and loss of discipline are signals to stop. Respecting a psychological loss limit prevents small drawdowns from turning into account-ending streaks.

Finally, risk should decrease with smaller capital, not increase. Survival is the priority when capital is limited. Aggression belongs to experience and stability, not desperation. This mindset goes against popular trading advice, but it aligns with how traders actually survive long-term.

In the end, capital management is not a formula. It is a skill built through experience, mistakes and discipline. Markets will always carry risk. What separates survivors from failures is not prediction, but control. Protect capital in bad conditions, press intelligently in good ones and never confuse excitement with opportunity. Survival comes first. Growth follows. Freedom is last.

#ETHMarketWatch #GrayscaleBNBETFFiling #USIranMarketImpact #TrumpCancelsEUTariffThreat #WhoIsNextFedChair