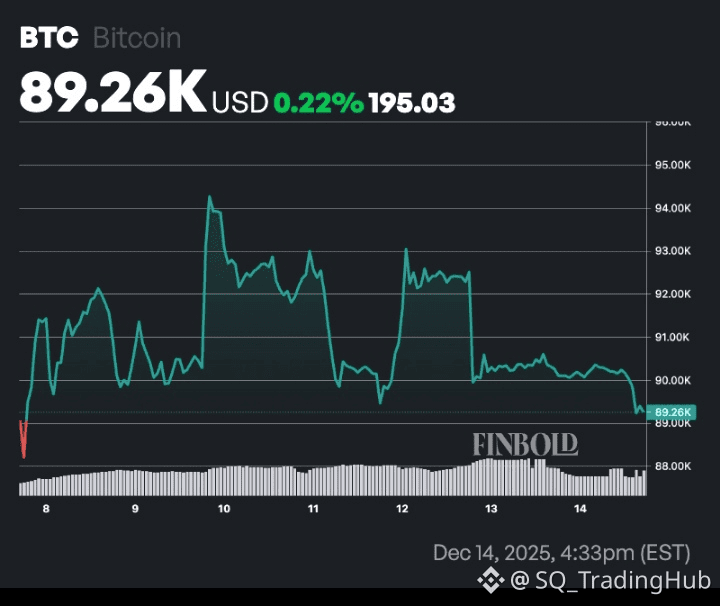

📉 Current Price Action

$BTC (Bitcoin) has been trading in a range roughly between ~$80K and ~$95K after pulling back from late-2025 highs.

Recent sentiment remains cautious, with low trading volumes and wide consolidation, suggesting the market is waiting for clear direction.

📊 Technical & Cycle Overview

Neutral/Short-term

The consolidation zone (~$85K–$94K) is key: a sustained breakout above could resume upside momentum, while a drop below could invite deeper correction.

Long-term

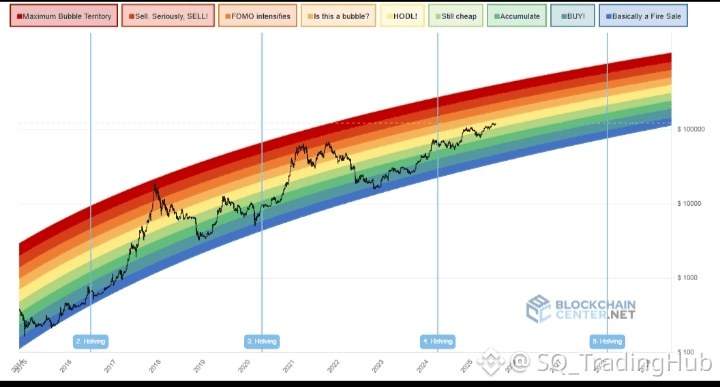

Some analysts argue the classic 4-year halving cycle may be evolving, with investors viewing Bitcoin more like a macro asset supported by institutional capital flows.

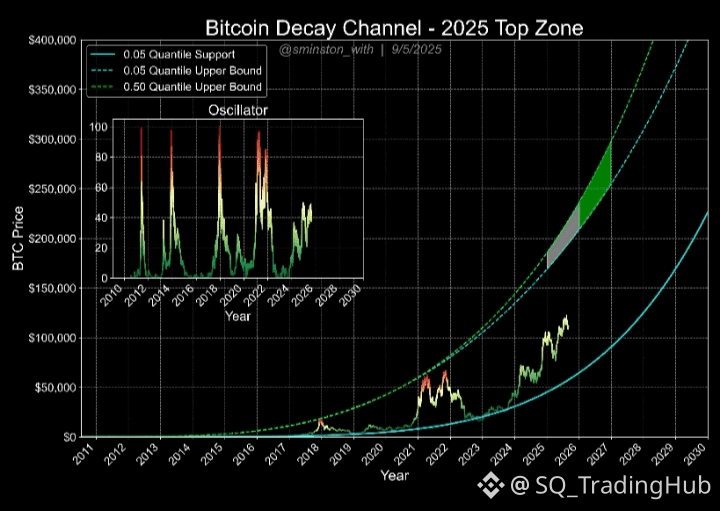

Others still point to historical technical patterns that could keep pressure on BTC into mid-2026 if corrective behavior persists.

📈 Forecast Range & Analyst Views

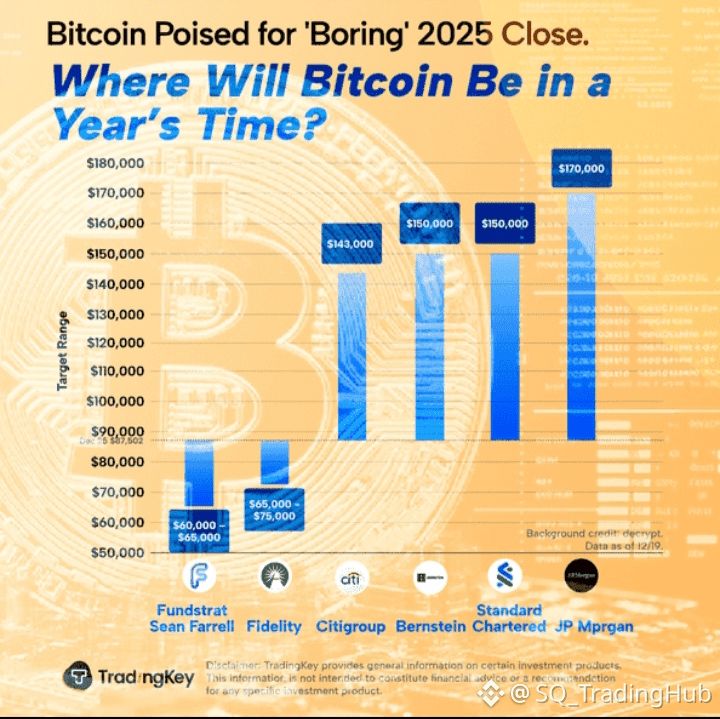

There’s a wide spread of forecasts for 2026 outcomes:

Bullish / Institutional-Driven

Major firms like Standard Chartered and Bernstein see Bitcoin reaching ~$150 K by late 2026 — suggesting structural adoption rather than short cycles.

Projections incorporating macro and long-term trend models even show higher endpoints if liquidity and ETF inflows accelerate.

Neutral / Range-bound

Some models keep Bitcoin in a steady growth trajectory without extremes, viewing the post-halving period as a more gradual uptrend than in previous cycles.

Bearish / Cycle Reversion Risk

Technical analysis still warns of potential deeper support tests (e.g., $65K–$75K) if downside momentum increases.

📌 Market Drivers to Watch

Bullish catalysts

Resumption of ETF inflows

Favorable regulation / policy clarity

Macroeconomic easing

Bearish pressures

Geopolitical tension hurting sentiment (e.g., trade wars) — recently linked to price dips.

Risk of volatility from advanced systemic threats (e.g., quantum computing concerns).

Summary: Bitcoin sits in a consolidation phase near ~$90 K with a wide range of potential 2026 outcomes. Short-term momentum is mixed, but many institutional forecasts lean bullish into later 2026 while technical patterns and macro noise remind traders of possible deeper support tests.#MarketRebound #BTC100kNext? #BTC100kNext? #StrategyBTCPurchase #CPIWatch