Is the recent $XRP dip a warning sign or a golden opportunity? Top analysts suggest that this correction is a necessary "shakeout" before the next parabolic move.

🔍 The "Grey Box" Strategy

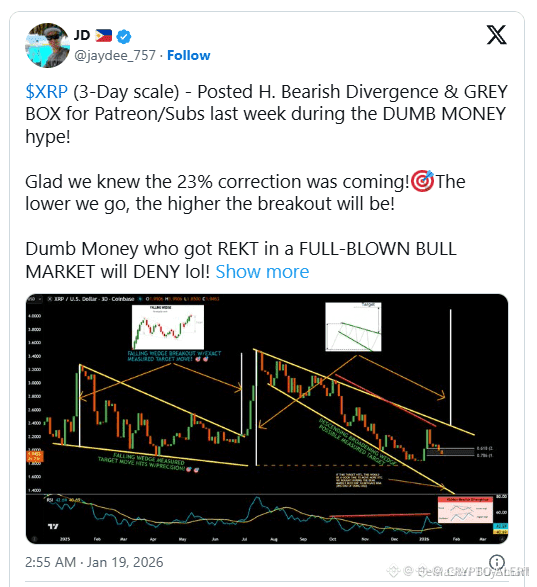

Renowned analyst JD recently highlighted a bearish divergence on the 3-day chart, predicting a pullback into a critical support zone—the "Grey Box" ($1.80–$2.00).

The Goal: Flush out "Dumb Money" hype.

The Result: XRP hit lows around $1.84 on Jan 19, perfectly testing this structural foundation.

📊 Why "Lower" Means "Higher"

📊 Why "Lower" Means "Higher"

In technical trading, a deeper consolidation often leads to a more violent breakout.

Accumulation: Smart money and institutions (who just poured $69.5M into XRP products last week) use these dips to stack.

Liquidity Sweep: By dropping below $2.00, XRP cleared out overleveraged long positions, creating a "cleaner" path upward.

The Target: If XRP holds this range, the next leg could challenge the $2.70 resistance and beyond.

🌍 The Bigger Picture

Despite short-term volatility caused by global trade tensions and "geopolitical theater," the long-term conviction remains high:

ETF Inflows: XRP spot ETFs saw $56M+ in net inflows last week.

Institutional Adoption: Inflows are up 18% this month as supply gets locked away.

Bottom Line: While short-term red candles sting, they are the fuel for the next rally. Patience is the name of the game. 💎🙌